Investment Portfolio Management

Investment Portfolio Management

Your portfolio is customized with your unique goals in mind.

THE ADVICE YOU NEED. THE SERVICE YOU DESERVE.

Custom Portfolios

Your portfolio is customized with your specific targets in mind. Our comprehensive investment planning process matches you with investment opportunities that align with your goals and personal risk profile. Our personalized services include:

- Customized Portfolio Management

- Dynamic Asset Allocation Process

- Data Driven Portfolio

- Actively Manage Underperforming Funds

- Diversified Approach

- Tax-Efficient Asset Location

- Proactive Risk Management

Investment Portfolio Services

We Focus on Three Things

We offer a full range of asset management solutions for whatever your unique financial needs require. As your portfolio manager, we use low-cost exchange-traded funds (ETFs) so you avoid the extra layer of management fees. We also use a risk management model designed to protect your portfolio, should the market falter. These methods help our attempts to tilt your portfolio toward favorable asset classes in the 12 to 18 months.

Most actively managed investment funds under-perform and charge you high fees. At the same time, you pay taxes on capital gains, even if the fund performed badly. Low-fee ETFs eliminate the high fees and taxes — that’s 3.5% you get to keep in your pocket.

Learn more about how to avoid using actively managed funds here.

For unique advice, contact us to get the conversation started.

Investment Portfolio Management

Every Impact Capital client has a dedicated and experienced financial advisor who will develop, implement, and manage a made-to-measure financial strategy that is fully aligned with your short- and long-term goals.

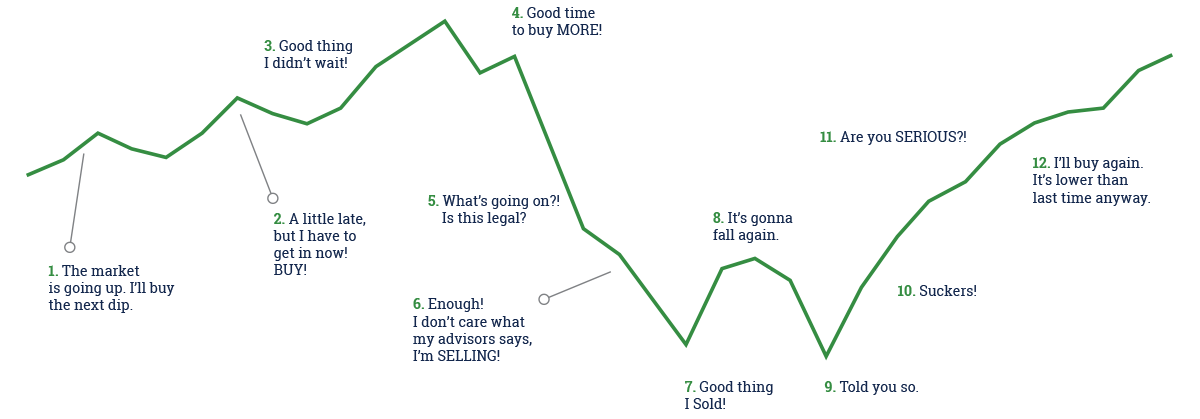

It Is Easier to Recognize Other’s Mistakes

Than Your Own

Impact Capital is led by seasoned financial advisor Bill Bancroft, who has been advising high net-worth families for more than 24 years. The company primarily serves families, recent or soon-to-retire individuals, executives, and those planning to sell a business.

Unlike other wealth management firms who primarily outsource portfolio management to third-party managers, Impact Capital breaks the mold by marrying low-cost ETFs with its proprietary tactical and risk-management processes.

By cutting out the third-party middlemen, Impact Capital clients are expected to benefit from the reduction of fees and increased tax efficiency, giving clients more for less.