The IRS recently announced various adjustments to retirement plan and annual gifting limitations for 2024. Here are the key takeaways from their announcement:

New Changes to Required Minimum Distribution Guidelines

If you were born in 1951, 2024 marks the first year you will need to take required minimum distributions (RMD) from your traditional retirement accounts. The government views your IRAs as IOUs and now they are ripe and ready to collect.

In some cases, it may make sense to delay this course of action until April 2025, but then you would be taking two distributions in the same year. This only makes sense if you expect your income to be lower in 2025 compared to 2024.

In many cases, the most tax-efficient way to give to charity is by using your RMD. While your RMDs are considered taxable income, this income is not taxable when you donate your RMD to charity. The charity gets funding, you fulfill your minimum distribution requirement, and you don’t pay additional taxes on the income – it’s a win-win scenario for everyone (except the government)!

Still Working For a Living? Now You Can Contribute More to Your Retirement

For those of you under the age of 50 who are currently working, the amount you will be able to contribute to your retirement plans (401(k)/403(b)/TSP) will increase slightly from $22,500 to $23,000. Assuming you fall below the income limits, the amount you can contribute to IRAs will increase from $6,500 to $7,000.

Turning 50 Next Year? Time to Play “Catch-Up” on Retirement Savings Contributions

If you were born in 1974, congratulations in advance on reaching the age (50) where you can begin making “catch-up” contributions to your retirement plans for the first time!

The total amount you will be able to contribute to your 401(k)/403(b)/TSP in 2024 will be $30,500, which accounts for both the catch-up amount of $7,500 and the regular annual amount of $23,000. It doesn’t matter when your birthday falls in the calendar year. Ideally, you would update your retirement contributions to reflect this higher amount beginning January 1, 2024.

There are also catch-up contributions for IRA contributions. Assuming your income level falls below the stated limits, the amount you can contribute to an IRA will increase from $7,500 to $8,000.

‘Tis The Season of Gifting

According to the IRS’ announcement, the annual gift exclusion — the amount you can gift to any person without having to file a gift tax return — will rise from $17,000 to $18,000. If you are thinking of making a gift, consider gifting appreciated securities to charity or family members in a lower tax bracket, as neither group will have to pay capital gains taxes.

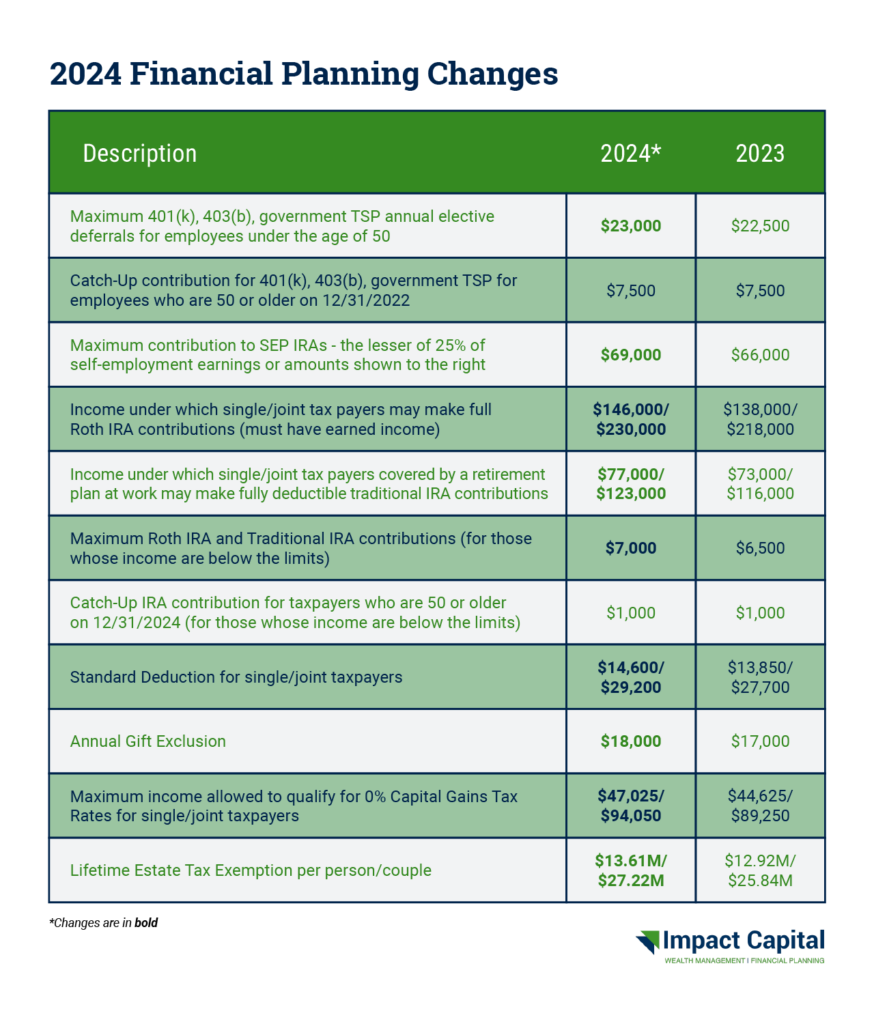

For more information on how the IRS’ recent announcement may affect your financial planning strategies next year, see the table below.

If you have any questions about the information above, don’t hesitate to reach out to your financial advisor!

STAY IN THE LOOP