The word “inflation” has gotten a lot of buzz lately — and for good reason. Inflation impacts just about everyone’s financials in one way or another, but it can be [...]

December 2021 Chart of the Month: FOMO Is A Four-Letter Word That Spells Trouble for Smart Investing

“FOMO” is an acronym that stands for “Fear Of Missing Out”, which refers to the all-consuming anxiety we feel when we perceive others to be doing something we should be [...]

The IRS recently announced various adjustments to retirement plan and annual gifting limitations. For those of you who are currently working, now you can contribute a little more to your employee [...]

Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In this installment of Three Market Themes, we focus on the [...]

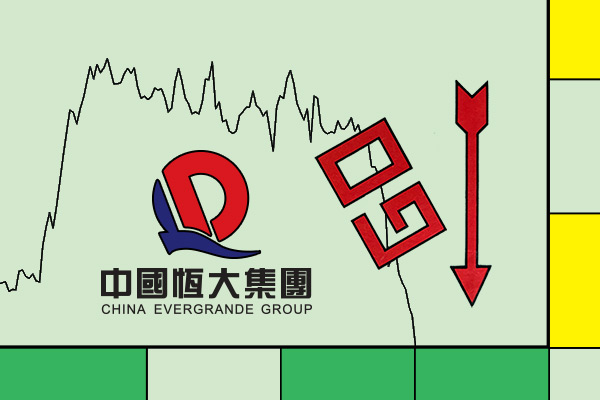

Executive Summary You may have recently heard the news buzzing around the word Evergrande, but what exactly is it? We can assure you Evergrande is not the name of Starbucks’ [...]

The people who know me have often heard me say being a financial advisor is like being half computer and half armchair psychologist. On one hand, the computer in us [...]

Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In this installment of Three Market Themes, we focus on the [...]

Earlier this month, the annual inflation rate—as measured by consumer prices nationwide—was recorded at 5%, which marks its highest reading in almost 13 years. We weren’t surprised, given that the [...]

In April 2021, U.S. consumer prices jumped, reflecting both the post-pandemic economic recovery and the emergence of supply bottlenecks. The U.S. Department of Labor reported that its consumer-price index increased [...]

For everyone living in the 21st century, it is clear how the advent of new technologies over the last three decades has shaped various aspects of our lives and the [...]