Executive Summary

You may have recently heard the news buzzing around the word Evergrande, but what exactly is it? We can assure you Evergrande is not the name of Starbucks’ largest cup of coffee, but rather the name of China’s largest real estate developer. For years, the China Evergrande Group borrowed money to build homes for Chinese citizens. Now Beijing’s crackdown on debt is leaving the company in financial distress. Like most things in life, debt can be very helpful when used in moderation, but borrowing colossal amounts of money relative to the collateral for the debt is a recipe for disaster. The company is now on the brink of collapse, leaving the rest of the world reeling and trying to understand the effects it may have on the global financial system.

What is Happening?

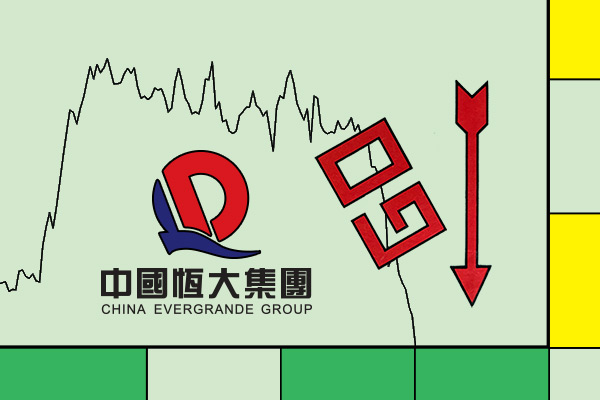

The Chinese government launched a campaign to reign in debt-fueled speculation in their real estate markets to lower inequality and keep housing affordable. Government officials capped the exposure banks can have to real estate and restricted some developers from taking on new debt. Unfortunately, there is no pain-free way to reduce leverage from the system. Housing prices in China have dropped by 19% over the last 12 months. Without access to new debt, Evergrande has halted ongoing construction projects and recently started paying its bills to suppliers with unfinished properties. It is just like watching a real-life game of Monopoly—the famous real estate board game—play out: when you are short on cash, you need to sell properties to avoid bankruptcy. They tried to sell assets and restructure their debt to no avail. Evergrande’s total outstanding debt is estimated to be $300 billion, about 42% of which comes due in less than a year. The company now has the biggest debt burden of any publicly traded real-estate management or development company in the world. A chart of the company’s stock price as of September 20th is shown below.

What Happens Next?

The consensus view is that Beijing will let the firm fail and stick bondholders and stock investors with the bill, but what is uncertain at this point is how far the Evergrande failure will reach. Think of it like ripples in the water: the companies closest to the company and the industry will feel the largest effect such as their suppliers as well as the banks that funded them. The properties serve as the collateral for the loans, so the bank will require more collateral if the property values fall. In an environment when developers can’t provide more collateral or make down payments, they end up defaulting on the loan. The rate of defaults on high-yield debt from Chinese developers this year exceeded the rate of defaults in the last 12 years combined.

What Does It Mean for Me?

In terms of your long-term investment plan, this news doesn’t change anything. The long-term is what matters the most.

In the short-term, the U.S. stock market was priced for perfection in an imperfect world. The China Evergrande story is one of these imperfections. Naturally, in the short-term investors are inclined to sell first and ask questions later. That being said, the volatility could be here for only a month or be forgotten about by Thanksgiving. Trying to play a short-term game of “sell now and buy later” is difficult because when it is time to buy, you probably won’t want to.

We will be looking to capture tax-loss harvesting opportunities and rebalance portfolios should the market sell-off cause portfolio allocations to change dramatically, all while remaining tactical when putting new cash to work. As always, we will look for opportunities to overweight portfolios in investments we predict will have considerable upside over the next 18 months but are temporarily down in the short-term due to these recent news developments.

STAY IN THE LOOP