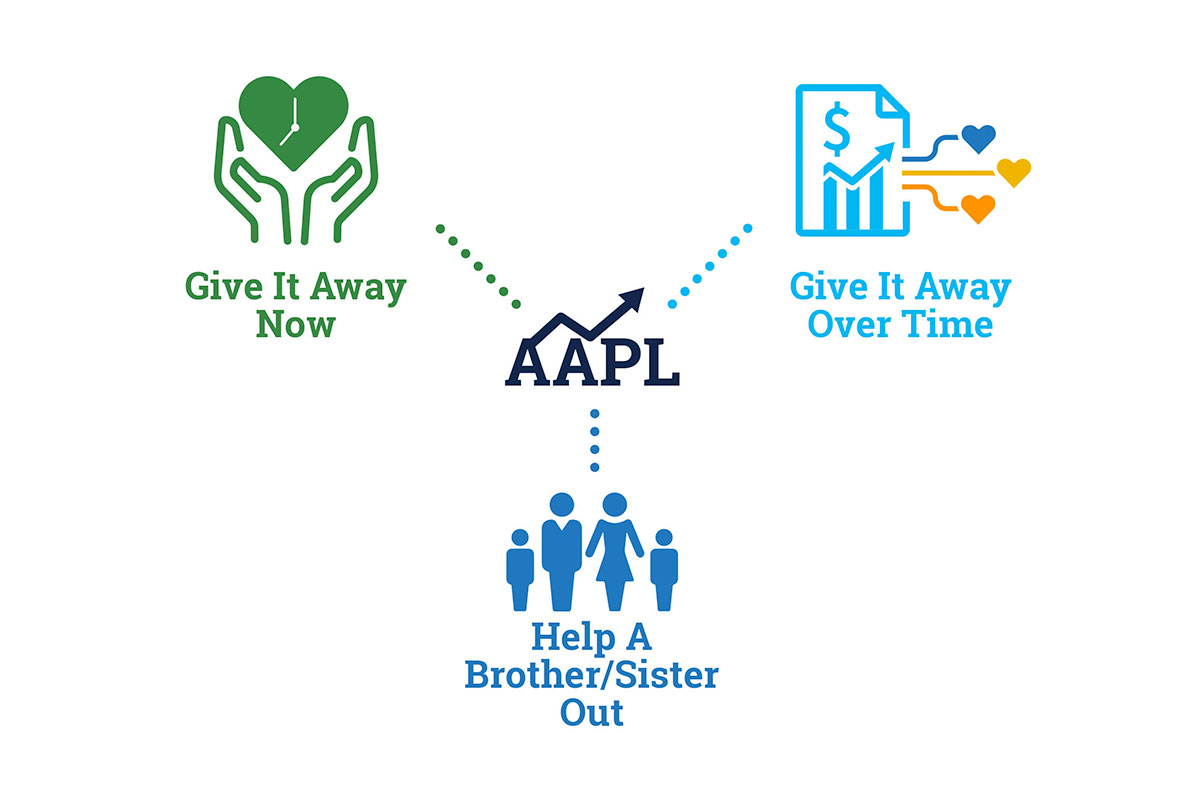

In the previous post of this blog series, we discussed trading tactics around selling strategies. The focus of this blog post will be on how to give away your AAPL stock using a tax advantaged approach. These strategies are for investors who are charitably inclined and are not relying on the AAPL stock to fund their lifestyles.

Give It Away Now

You can contribute AAPL shares that you have held for over a year to charity and receive a deduction for the full market value of the appreciated stock up to 30% of your adjusted gross income (AGI), assuming you are able to itemize your deductions. There is also the added benefit of not having to pay capital gains tax on the appreciated value. The goal is to support your cause of choice and not only avoid taxes, but receive a tax benefit.

Give It Away Over Time

A Donor Advised Fund (DAF) is a charitable account from which you can nominate grants to charity. The process comprises of three simple steps: 1) you contribute your appreciated AAPL stock to the DAF; 2) the DAF—a charitable account for which there are no taxes to be paid— sells the stock and; 3) you can decide which charities to support in the future. There are no requirements dictating when those charitable donations need to be made, but the charities need to be 501(c)(3) approved non-profit organizations. A DAF is helpful in allowing people to receive a deduction for their charitable contributions by lumping together multiple years of contributions into one year. You would receive the charitable deduction for your contribution in the year you make the contribution, not when the grants are distributed to charity. Unlike a private foundation, a DAF does not file a tax return or require lots of administration, and you can deduct up to 30% of your AGI for donated appreciated assets – just like in the scenario we have described.

Help A Brother/Sister Out

You can gift anyone up to $15,000 in any given year. If you are married, you and your spouse could give a combined $30,000 to someone in any given year, or you can give someone in your family—specifically, a family member in a lower tax bracket than you are—appreciated AAPL stock. Depending on their income, they may be able to sell the stock and avoid capital gains taxes. Single taxpayers with less than $40,000 of income avoid capital gains taxes along with joint filers with less than $80,000 of income.

Minors can also avoid capital gains taxes if their income is less than $4,700, which would require a custodial account to execute. With this type of account, the minor will be able to use the funds however they please once they come of age.

I hope you enjoyed reading this blog series as much as I enjoyed writing it. As I sign off on this series, I will leave you with one last message: as you plan your next market move, it is crucial for you to work with a financial adviser who: 1) is a fiduciary, and 2) has seamlessly integrated your financial planning with your tax planning.

STAY IN THE LOOP