Suppose you bought Apple (AAPL) stock years ago and now it is worth more than you are comfortable with — perhaps more than 10% of your overall portfolio. The dollars involved are larger than you could have ever imagined, but so is the risk. To assuage your anxiety, you are contemplating selling some shares, but are concerned about paying taxes on those sold shares. This blog series will walk you through how to evaluate those risks and design a process to meet your goal of reducing risk.

Death and Taxes

If you have significant assets outside of your AAPL position to fund your lifestyle, you don’t necessarily have to sell shares. Upon your passing, your heirs will receive the shares with stepped-up cost basis. Later in this series, we will cover strategies for you to reduce risk and—if you are charitably inclined—to gift shares in a tax advantaged way.

Calculating the Tax Cost

There is a way to calculate the tax cost as a percentage of your position so you understand when selling would be advantageous. To compare apples to apples (pun intended), let’s calculate the potential tax cost as a percentage of your AAPL position.

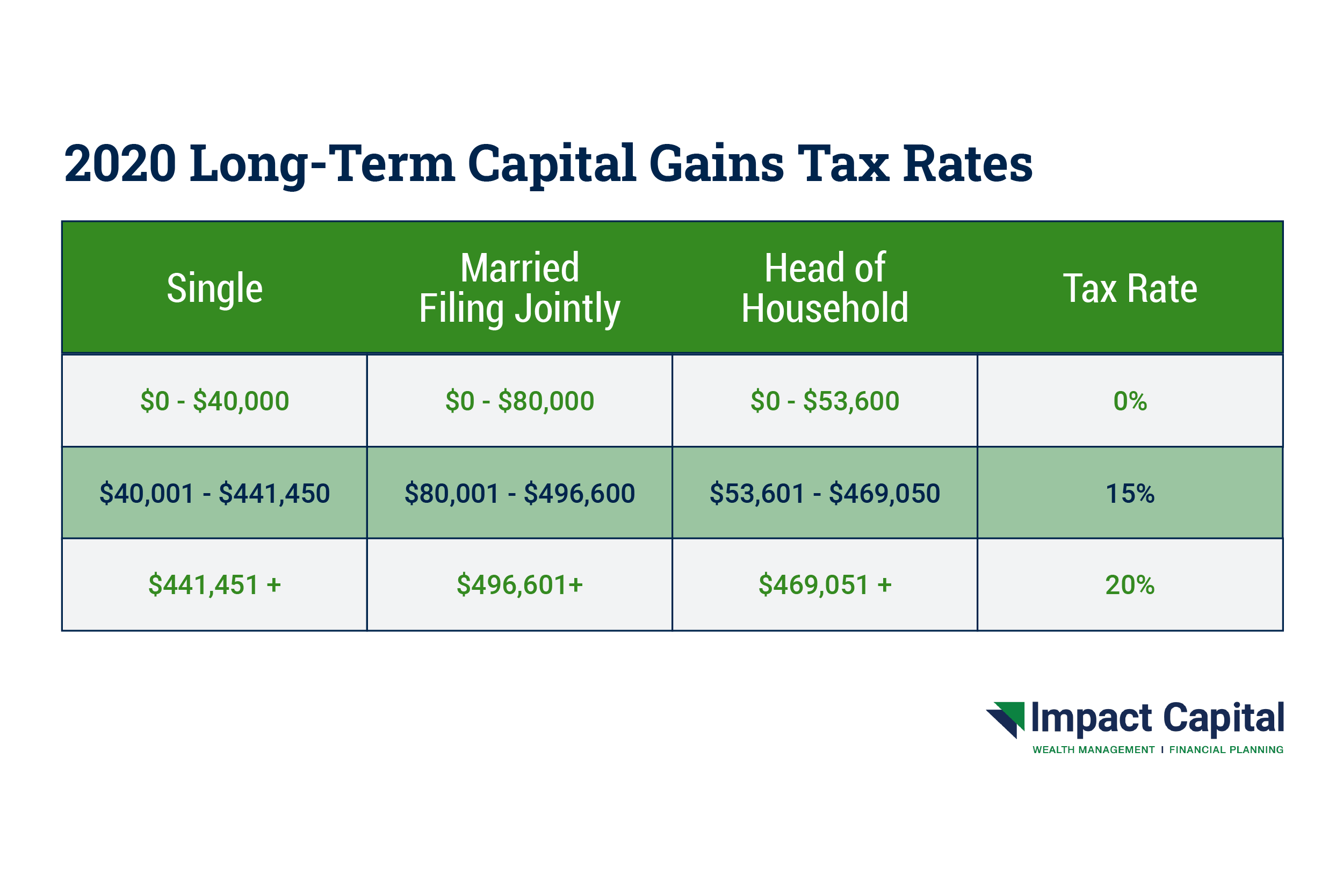

Your tax rate is based upon, among other things: 1) how long you held the stock; 2) your household’s income, and 3) your state/local tax rates.1 The table below lists the long-term capital gains rates for 2020.

There is also possibly a 3.8% Net Investment Income Tax for investors whose modified adjusted gross income is over the thresholds, listed in the table below:

Understand the Tax Cost vs. The Risk of AAPL Falling

Let’s assume the following scenario: you are married, live in Florida, have a household income of $300,000, and have held the stock for longer than a year. Your capital gains tax rate would be 18.8% (15% Long-Term Capital Gains Tax + 3.8% Net Investment Income Tax). Furthermore, let’s assume that you bought 500 shares of AAPL in 2019 for $200/share and it is now worth $500/share. The tax cost is your gain multiplied by your tax rate, so you will need to divide the tax cost by the size of your position to determine the tax cost as a percentage of your position.

Your tax cost represents 11.28% of your AAPL position. If you are afraid of the stock falling 5%, you should hold the stock, since the taxes would cost you more than the stock dropping. Selling the stock would be the right choice only if it fell more than 11.28%.

Now that you understand just how far the stock would need to drop before it would make sense to sell your shares, we will spend the next iteration of this blog series focusing on trading strategies.

1 For the purposes of this blog, we only mention some of the factors that can impact the taxes you will owe. We recommend obtaining a tax projection from your accountant or financial advisor to understand all the potential tax consequences.

STAY IN THE LOOP