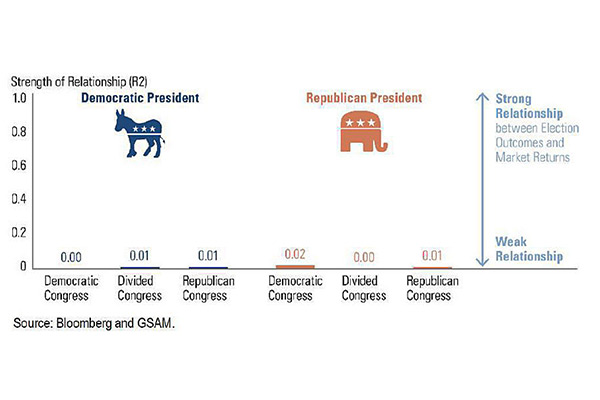

1. WHICH POLITICAL PARTY IS BEST FOR THE STOCK MARKET?

It doesn’t matter. The chart shows the performance of the stock market is completely independent of politics. We recommend your portfolio be built to last your lifetime, not just the next four years. We do not recommend making portfolio changes based on politics.

See Disclosure #1

2. HAVE INTEREST RATES BOTTOMED?

The stock market sell-off earlier this year ignited a flight to the safety of bonds, pushing interest rates (30 Year US Treasury Bond rate shown left) to historical lows. Interest rates have now risen the last few months. Historically, investor future returns in bonds are correlated with where interest rates are when you purchase them. With rates so low, this historical relationship may be implying limited upside for bond investors.

3. HOW DEFINED OUTCOME ETFS WORK

With interest rates low, bonds may have limited upside. Stocks can be volatile over short time frames. The outcome-based ETFs we are using offers investors exposure to stocks but with some protection against short-term losses. In exchange for this protection, investors are accepting a limit on their upside participation. The reward/risk ratio can be very attractive when their price is in the protection zone with limited time to expiration.

See Disclosure #2

DISCLOSURES

Disclosure #1

The statistic R-squared measures how much variance in one variable is explained by another variable. A reading close to 0.0 suggests no relationship between the variables. Analysis from December 31, 1946 to December 31, 2019.

Disclosure #2

The charts illustrate just one version of a defined outcome ETF for educational purposes. There are ETFs that cover many different underlying indices besides the S&P 500. There are ETFs that offer different levels of protection and upside participation. There are ETFs with different expiration dates, too. The key is to time your purchase when they are trading at a discount to your expected outcome. We do not recommend you invest in defined outcome ETFs for the long-term. Source: https://www.innovatoretfs.com/pdf/defined_outcome_mechanics.pdf

STAY IN THE LOOP