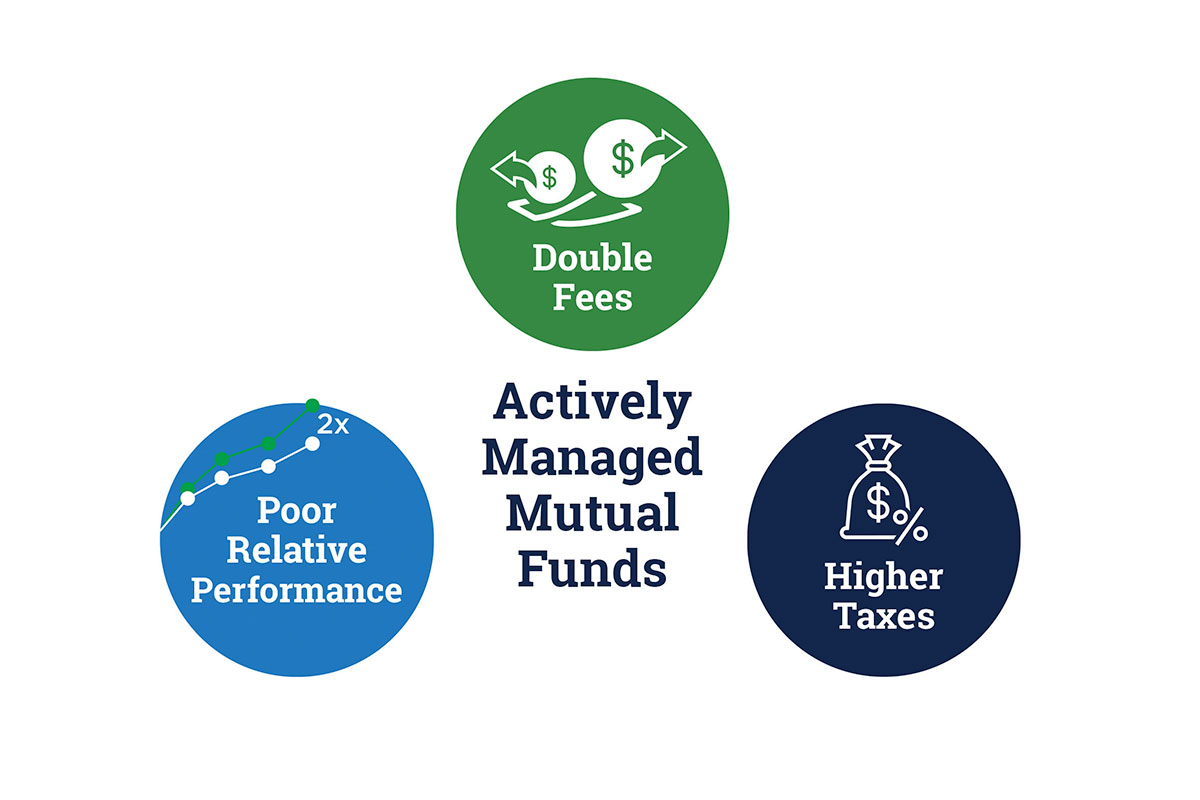

Since we launched Impact Capital in 2018, we’ve evaluated many prospective client portfolios. The most common mistake we’ve observed is working with advisors who recommend actively managed mutual funds they believed would beat the market. Here are three reasons why this approach to portfolio management should scare the proverbial Thanksgiving stuffing out of you:

- Double Fees: You pay your advisor a fee, but what you may not realize is that you may also pay a management fee to each mutual fund. Here is the tricky part: your statements do not explicitly show the mutual fund fees. Instead, they are embedded in the fund itself. Without doing some research, you may not know the fees you are really paying.

- Poor Relative Performance: Most funds underperform the market. Although your mutual fund may have gone up in value, you probably would have been better off owning the market instead of your mutual funds. The data from S&P/Dow Jones is clear: As of 6/30/2020, it shows 77% of US Large Cap mutual funds have underperformed the S&P 500 over the last five years. The numbers are worse the further out back you look. Now that you know the odds, you understand your advisor has been playing a losing game with your money.

- Higher Taxes: Mutual funds must distribute capital gains to investors each year, even if you don’t make any changes to your portfolio. Even if you are a good long-term investor, it is likely you will be saddled with a sizeable tax bill as a direct result of your advisor’s recommendation to select mutual funds.

Mark Twain once said “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

The same is true when it comes to taking overly confident financial advisors at their word. Why do advisors continue to risk your money in mutual funds against the odds listed above? Well, to put it bluntly, some “advisors” are just salespeople who get paid more if you invest in the firm’s funds. Some advisors lack the humility to admit the reality of the situation, and may have instead sold you on the idea they have special investment skills the rest of the world does not possess. They are afraid to admit their lack of skill out of fear you will fire them—which you should—and elect to hide their deficiency by not showing you clear comparisons of their performance versus benchmarks over time.

WHAT SHOULD I DO?

The first step is to start asking tough questions: How has my portfolio performed against the benchmarks net of all fees within the last 12 months? Within the last three years? Within the last five years? Since its inception? What percentage of my portfolio do I pay in fees each year? What taxes do I have to pay because of the portfolio?

The second step is to seek out Registered Investment Advisors (RIAs), like Impact Capital, who are legally obligated to put your best interests first and recommend low fee, tax-efficient investments that match the market’s performance.

As an investor, you are relying on your financial investments to last you a lifetime. Over time, the cumulative sum of higher fees, poor relative performance, and higher taxes has the potential to materially change what type of retirement you will have. The sooner you can correct these problems, the better off you—and your investment portfolio—will be.

STAY IN THE LOOP