The S&P 500 is up 4.4% year-to-date, yet people are losing their jobs; they aren’t paying their rent; store shops are shuttered; malls are empty; no one is flying or going on a cruise; restaurants, bars, and casinos are struggling. The stock market being up seems to be at odds with these realities.

The year-to-date (YTD) performances of some of those industries, namely Airlines, Hotels, Resorts & Cruise Lines, Department Stores, Retail Real Estate, and Casinos are down 46%, 48%, 56%, 42%, and 40.9% respectively. Keep in mind these numbers are as of this week, months removed from the March bottom in the market, meaning there is more to the story.

A market is the sum of all the individual industries, but not all individual industries are equally-weighted within the market. The weightings of those industries are as follows: Airlines – 0.19%; Hotels, Resorts & Cruise Lines – 0.24%; Department Stores – 0.01%; Retail Real Estate – 0.21%; Casinos – 0.11%. If you add these up, the total only comes to 0.77%. While those industries are crucial to society, they are not significant for the performance of the markets.

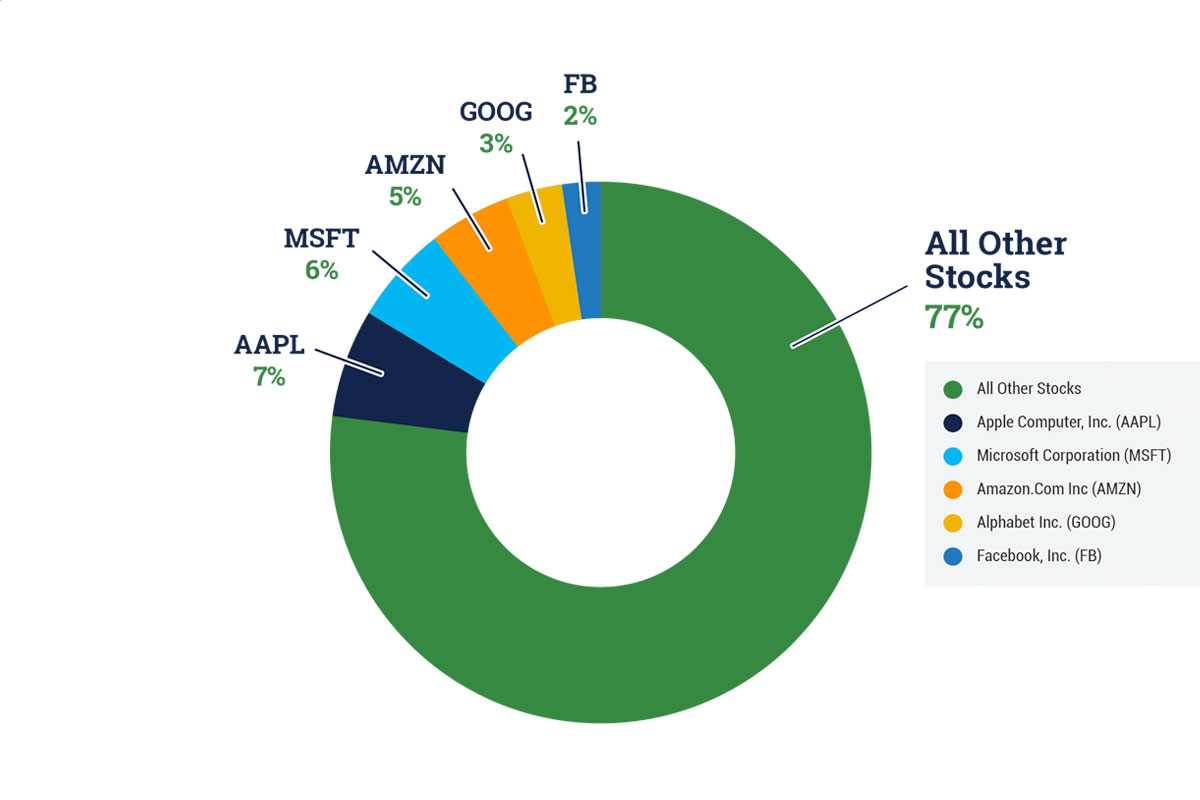

If those entire industries don’t matter to the markets, then what does? Five individual companies – companies, not industries – make up 22% of the S&P 500. Please see the graphic below:

These stocks alone have contributed to the 9.6% of the market rise this year. An equal-weighted version of the S&P 500 is still down 2% this year.

Why these stocks? Their businesses were market leaders before the COVID-19 pandemic, and the pandemic has only increased their advantages This, in turn, explains how the market is up and rising in the face of dire economic challenges. The market isn’t crazy; it’s just collectively weighing large company winners more than smaller company losers.

STAY IN THE LOOP