This time of year, everyone loves to predict what the new year will hold for the stock market. “Best Stocks For 2021” is a headline that typically makes the rounds, but it is worth noting that these predictions are a form of marketing. A prediction that stock market predictions will be wrong has better odds of being true than most stock market predictions. Feel free to read them for fun, but I wanted to share a more meaningful strategy that will empower you to better meet your goals this year. This strategy is called “backcasting.”

WHAT IS BACKCASTING?

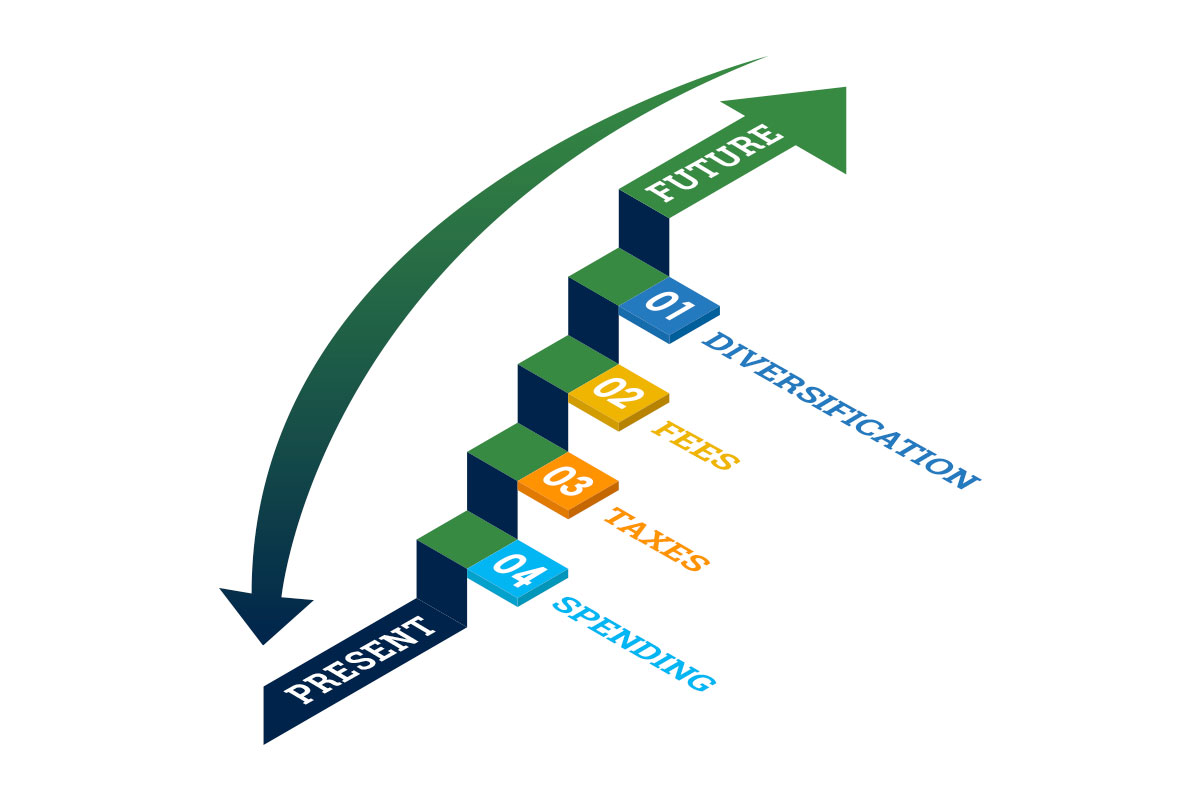

Backcasting is a decision-making process where you imagine a bright future where you already achieved your desired goal. Once you have that image in your mind, consider what smaller steps had to happen to produce your positive outcome. You can then start your process toward your goal by working on making those smaller steps happen.

The main issue with forecasting is that we start with the present; we have an inherent assumption that the future will resemble the recent past. A more honest title for the “Best Stocks for 2021” would be “Best Stocks from 2020” since many of the stocks listed happen to be the ones that did well in 2020. Yet we know just because a stock has done well in one year does not necessarily mean that it will do well in the following year. Starting with the future and working back to the present removes our anchor to the recent past and allows for a more logical thought process.

Suppose your main goal is to grow your wealth in 2021. While we can’t control the market, we can control some other factors:

- Diversification – How an individual stock may perform from year to year is difficult to predict. The range of outcomes for an individual stock over any given year is extremely wide. There is a risk the stock you pick underperforms the market. To mitigate this risk, we recommend holding stocks from the entire global stock market. No single stock will make or break your portfolio under this approach, and the range of outcomes for the performance of the global market is much smaller than the range of outcomes from an individual stock.

- Investment Fees— Fees represent a hurdle between you and your goals, so it is important to minimize them wherever possible. This includes not only our own fee, but also the fees embedded in your investments. This is one reason why we use low-fee exchange traded funds in your portfolio, as well as why we use a low-fee custodian such as Charles Schwab.

- Taxes – Taxes are a direct transfer between you and the government. It makes sense to minimize them whenever possible. This means avoiding short-term trading and mutual funds that distribute capital gains to you. Having a financial plan that incorporates a long-term outlook and plans to pay taxes when your tax rate is the lowest is one way to help grow your wealth over time.

- Spending – Withdrawals from the portfolio make it harder for it to grow over time. Keep in mind your portfolio should represent your future goals and wishes.

WHAT SHOULD I DO?

Backcasting is designed to help you identify the steps needed to achieve any type of goals, not just financial ones. The questions that should come to mind as you make everyday decisions are “What do I want to have happen?” and “Which decision will get me closer to what I want?” The more you stop and ask yourself these types of questions, the closer you will come to achieving your goals.

STAY IN THE LOOP