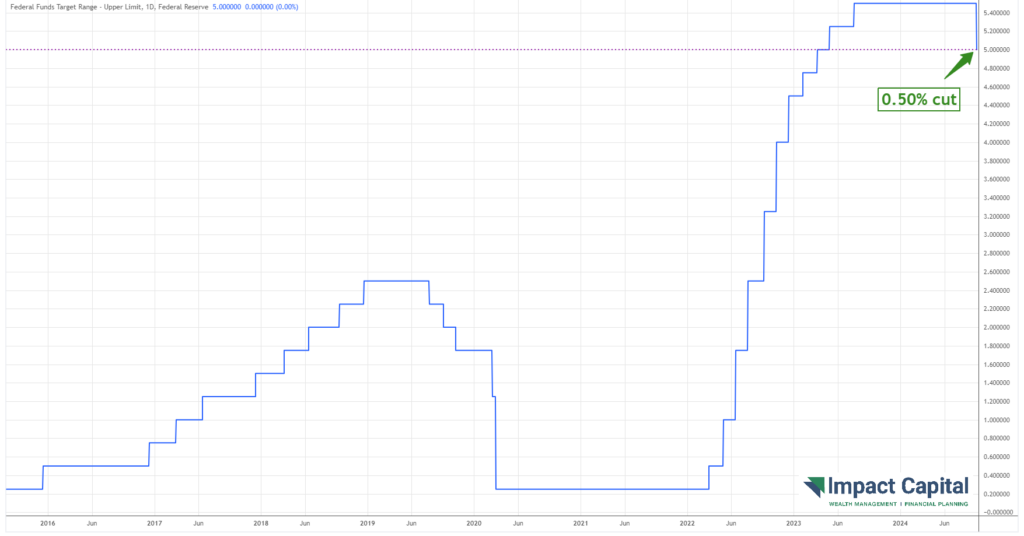

On Wednesday, September 18th, the Federal Reserve announced that it would lower interest rates by 0.50%, marking the first reduction in interest rates by the Fed since 2020. The Fed has two key mandates: Maintaining price stability and maximum employment. Feeling confident that inflation has been tamed, the cut in rates is intended to try to maintain the strength in the labor market.

Jerome Powell, Chair of the Federal Reserve, issued the following statement at a press conference held by the Fed: “We are committed to maintaining our economy’s strength. This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained.”

The chart below depicts the Fed’s upper limit on interest rates the last few years.

Jerome Powell, The Man Behind the Wheel

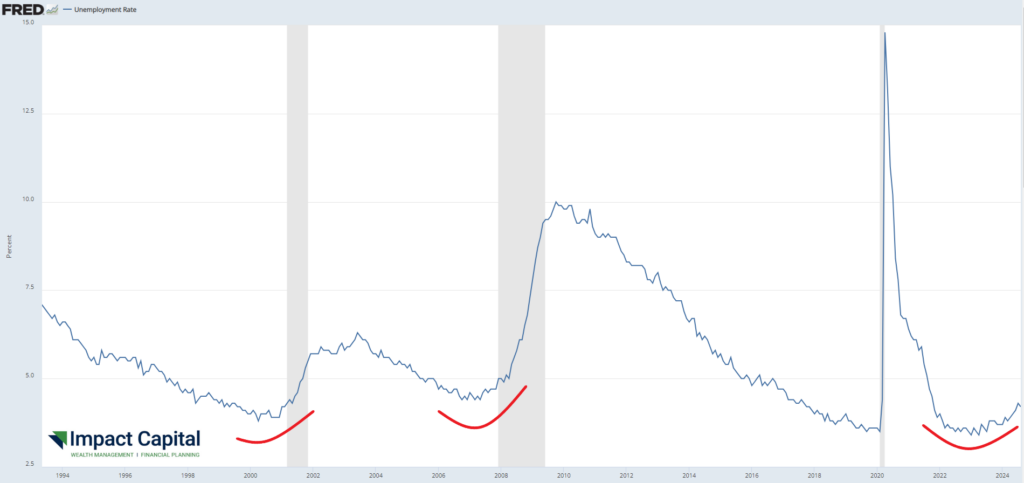

If you liken the economy to a racecar, then the Fed is the driver and interest rates are the gas and brake pedals. When inflation was hot and on the rise, they slammed on the brakes to cool and lower inflation. Now that inflation has receded, they felt comfortable putting the pedal to the metal (or at least easing their foot off the brakes). While the unemployment rate is still historically strong, it has started veering in the wrong direction, as seen in the chart below. In the past, this has coincided with recessions, which are depicted as the shaded areas in the chart.

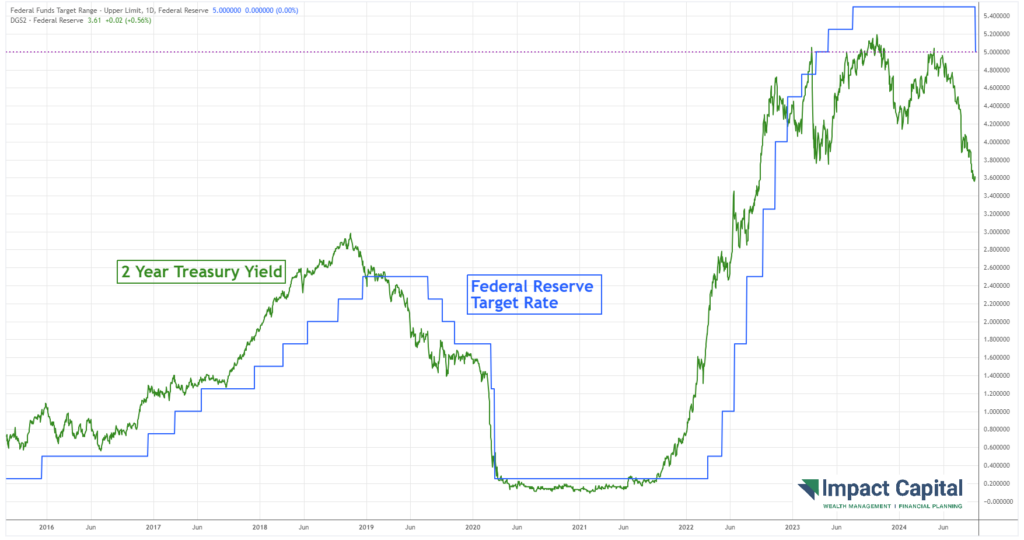

The Fed Did What the Markets Told It To Do

I will let you in on a little secret: The markets always inform the Fed on what should be their next move. In the chart below, the 2-year U.S. Treasury yield is shown alongside the Fed’s upper limit on interest rates over the last few years. In the chart, the 2-year U.S. Treasury yield appears to be leading changes in interest rates and start climbing before the Fed raised rates, and it starts falling before the Fed cut rates.

This explains why some interest rates, like mortgage rates, have already been on the decline. The change in interest rates will lower the yield on Treasury Bills, but also will lower the rates charged by credit cards. Lower rates may spell bad news for banks and other lenders, since they won’t be able to receive as much interest from the Fed as they previously did.

Looking Forward

The 2-year U.S. Treasury yield is advising to expect more interest rate cuts in the near future. Of course, this can always change, but right now it is projecting cuts over 1% within the next two years. In their press release announcing the interest rate cut, the Fed stated: “In assessing the appropriate stance of monetary policy, the [Federal Open Market] Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.”

Like the Federal Open Market Committee, we will continue to monitor the market and adjust our guidance as new developments arise.

STAY IN THE LOOP