The IRS recently announced various adjustments to retirement plan and annual gifting limitations for 2025. Here are some key highlights to note:

New Changes to Required Minimum Distribution Guidelines

If you were born in 1952, 2025 marks the first year you will need to take required minimum distributions (RMD) from your traditional retirement accounts. The government views your IRAs as IOUs and now they are ready to collect.

In some cases, it may make sense to delay taking action until April 2026, but then you would have to take two distributions in the same year. This course of action only makes sense if you expect your income to drop in 2026 compared to 2025.

In many cases, the most tax-efficient way to give to charity is by using your RMD. Your RMDs are generally considered taxable income, but when you donate your RMD to charity, the income is not taxable. The charity gets funding, you fulfill your requirement, and you don’t have to pay taxes on your RMD – everybody wins (except for the government)!

Still Working For a Living? Now You Can Contribute More to Your Retirement

For all of you under the age of 50 and still working, the amount you will be able to contribute to your retirement plans (401(k)/403(b)/TSP) will increase slightly from $23,000 to $23,500. Assuming you fall below the income limits, the amount you can contribute to IRAs will remain the same at $7,000.

Turning 50 This Year? Time to Play “Catch-Up” on Retirement Savings Contributions

If you were born in 1975, congratulations in advance on reaching the age of 50! You can now make “catch-up” contributions to your retirement plans for the first time.

The total amount you will be able to contribute to your 401(k)/403(b)/TSP in 2025 will be $31,000. The catch-up amount is $7,500 and the regular annual amount is $23,500. It doesn’t matter when your birthday is during the year. Ideally, you would update your retirement contributions to reflect this higher amount beginning January 1, 2025.

There are also catch-up contributions for IRA contributions. Assuming your income falls below the stated limits, the amount you can contribute to an IRA will increase from $7,500 to $8,000.

Turning 60 This Year? Now’s Also the Time to Play “Catch-Up” on Retirement Savings Contributions

This is the newest in new! For the first time, if you are between the ages of 60 and 63, you are eligible to make a larger catch-up contribution of up to $11,250 in 2025. If you were born between 1962 and 1965, the total amount you will be able to contribute to your 401(k)/403(b)/TSP in 2025 will be $34,750.

Make a Resolution to Gift More This Year

According to the IRS’ announcement, the annual gift exclusion limit – the amount of money you can gift to any person without having to file a gift tax return – will rise from $18,000 to $19,000. Consider gifting appreciated securities to charity or family members in a lower tax bracket, as neither group will need to pay capital gains taxes.

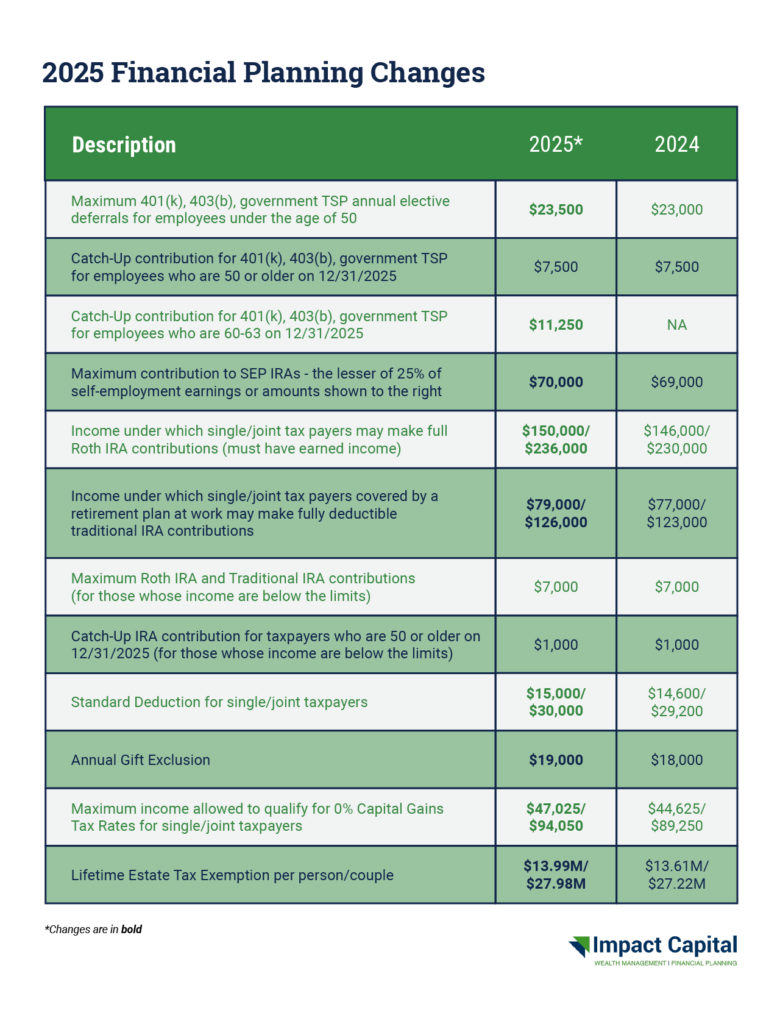

The details are listed in the table below.

Don’t hesitate to contact your advisor with any questions!

STAY IN THE LOOP