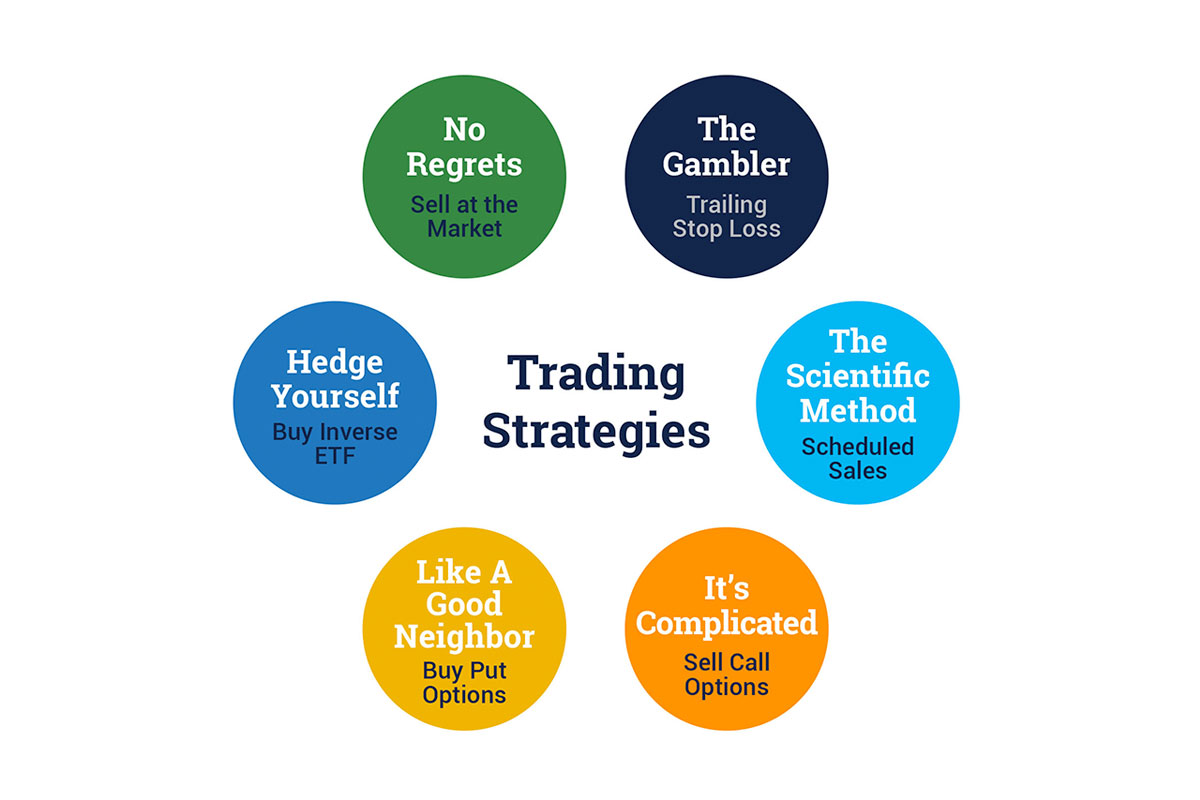

After reading Part One in this blog series, you understand the risk of AAPL falling is greater than the tax impact from selling it. You decide to sell some of your stock shares, but then another question quickly arises — exactly how should you sell the stock? Everyone has different goals when it comes to their investments, so it is crucial to work with a fiduciary advisor with extensive trading experience who will help find the right strategy for you. Here are some trading tactics to consider:

“No Regrets” – Sell Shares Now

This is for those of you who are more worried about risk than capturing more upside. The simplest approach is to simply sell some shares at the market. Selling at the market may feel arbitrary, but you realize no one can time the stock sale perfectly anyway. Be careful to only sell shares you’ve held for more than one year so the gain will be taxed using long-term capital gains tax rates. How many shares you decide to sell can be subjective, but one method would be to sell the amount that represents your profits from the last year. With the stock up over 100% in the last 12 months, you would sell half of your shares. This way, you have recouped your initial investment and have only profits invested. Another method is to sell the amount of shares required to bring your stock/bond mix back to your original targeted mix (this requires you have a targeted mix). In conjunction with my own technical analysis, this is the strategy I use most often with our clients at Impact Capital.

“The Gambler” – Trailing Stop Loss Order

This strategy is for those of you who are comfortable taking some risk in the hopes of participating in further upside in the stock. If AAPL keeps rising, you don’t want to sell; what you should do instead is place a stop loss order at a price under the current price, but exactly what price you enter the stop loss order depends on your risk tolerance. If you are open to “staying at the table” a little longer, place the stop loss order farther away (5%). If you don’t want to risk 5%, set it closer. If your advisor has a background in technical analysis, they can point you where the previous support level was for the stock. As the stock rises, raise your stop loss order with it. One note on stop loss orders: they do not protect you against the stock dropping overnight on bad news. If the stock opens below your stop loss order, you would sell at a price in the opening range.

“The Scientific Method” – Predetermined Sales

For those of you comfortable taking some risk and are not in a rush to sell your stock, this strategy is for you. Since you can’t project the future stock price movements, selling an equal portion of AAPL shares on a predetermined schedule lessens the impact of stock price movements. This is dollar cost averaging in reverse. This is the most intellectually honest approach, but it does leave you exposed to the future movements in the stock price.

“It’s Complicated” – Sell Call Options

This strategy offers upfront income, but your future upside is capped and your position is still exposed to future stock movements. The owner of a call option can buy AAPL at a given strike price before a given expiration date. You can sell call options above AAPL’s current price in return for an initial premium payment. If AAPL rises above the strike price, your shares will be sold at the strike price. You also have the choice of buying back the call options at a loss if you don’t want to sell the stock and incur taxes. What strike price you choose depends on your risk tolerance. The closer the strike price is to the current price, the higher the probability your shares will be sold so plan accordingly. Should AAPL not reach the strike price, you keep the stock and the premium payment, and then you can repeat the process. The downside of this strategy is your downside protection is limited to the amount of the initial premium received, which may not be significant in relation to the possible drop in AAPL’s price.

“Like a Good Neighbor” – Buy Put Options

Put options—which are the opposite of call options—allow investors to sell the stock at a given strike price before a given expiration date. You can buy a put option below the price of the stock so if the stock price falls below the strike price, you can still sell your shares at the strike price. What strike price you choose depends on your risk tolerance. The closer the strike price is to the current price, the higher the probability your shares will be sold, so plan accordingly. Again, if you don’t want to sell the stock and incur taxes, you could sell the put option for a gain. The taxes on the put option will likely be lower than the taxes if you sold appreciated shares. The price of this protection varies over time, but it can be expensive; if the stock doesn’t hit the strike price by the expiration date, you would have to buy protection again. One way to defray the cost of this protection is to also sell a call option above the stock price as we discussed in the “It’s Complicated” strategy. The technical name for this combined strategy is a collar position.

“Hedge Yourself” – Buy an Inverse Related ETF

This strategy is the most difficult for a trader to execute successfully. The goal of this strategy is to protect you against losses, without realizing the taxes on your highly appreciated AAPL stock. An Inverse ETF is one that moves the opposite of the market. They come in levered versions as well, but anytime you work with leverage, you need to be careful since leverage magnifies your gains or losses. A “related ETF” is an ETF expected to move similarly to your position. For example, the Nasdaq 100 (QQQ) is expected to move similarly to Apple since Apple is the largest holding in QQQ at almost 14%. You could buy an inverse version of QQQ, such as ProShares Short QQQ (PSQ), that is expected to move inversely to Apple. This is market timing and as such, very difficult to time perfectly. You are hoping the profit from your PSQ position will offset the losses in your AAPL stock. The benefit is you aren’t selling AAPL, thus avoiding the big tax bill. There are multiple risks with this strategy. One risk is PSQ acts differently than AAPL; if PSQ falls while AAPL goes down, you’ll lose on both sides of the trade. Another risk is if your timing is off and PSQ falls and AAPL goes up. It is important to understand the moment you put on this trade, you are capping your upside.

The above strategies are all trading tactics and can also be combined to achieve your specific goals. One operational note: custodians will require you to fill out additional paperwork to be able to trade options, so be sure to plan ahead.

There are other planning strategies to lower your risk besides selling or hedging AAPL, which we will discuss in our final blog post in this series.

STAY IN THE LOOP