“Stocks only go up!” is a joke you may have heard me say over the last few months. It has been true more often than not the last few months. The market has taken flight for a few reasons. The market doesn’t like uncertainty and there was a lot of uncertainty removed recently with the resolution of the China trade war and Brexit. On top of that, the Fed has been injecting liquidity into the system. They’ve also made it clear they are not going to raise rates any time soon. Therefore, investors believe we are in a “Goldilocks” scenario where the economy is not too hot or too cold. We are going along for the ride for now which is a good segue into our most recent market themes (below).

The Boomerang Effect

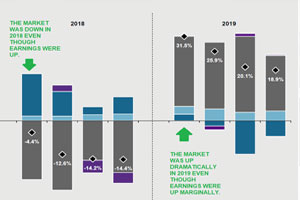

The first theme discusses the two drivers of market returns: earnings and multiple expansion. The main takeaway is how much investor’s attitudes towards stocks can influence prices in the short-term. In 2018, prices were down over trade uncertainty even though earnings were up a ton thanks to the tax cut. Last year investor’s attitudes caught up to earnings. They felt more confident about stocks and were willing to pay a higher price for earnings even though those earnings were not great. The late 90’s saw multiples expand at a double digit rate for four years in a row before the internet bubble popped. Outside of that exception, multiples have acted more like a rubber band, only able to stretch so far before it snaps back.

Time to Rebalance

The second theme discusses our methodology for rebalancing. We rebalance when we feel the underlying investment is stretched versus history and other investments in the portfolio. Even then, we take the tax implications seriously and prefer to make changes in non-taxable accounts if possible. We use analytical bands to alert us when an investment is high versus its history. We would look to trim investments whose price has moved above the top band and add to investments whose price has moved below the bottom band. It sure beats guessing!

SECURE Act

The third theme isn’t a market theme at all. Instead, it is highlights of the recently passed SECURE Act. The “Setting Every Community Up for Retirement Enhancement” (SECURE) Act was signed into law on December 20, 2019 as part of a larger government spending package. Overall, it isn’t changing much for current retirees. It is helpful for future retirees. The new law is painful for future heirs of retirement accounts.

Required Minimum Distribution Age Increase

The age at which you need to start taking distributions from your retirement accounts increases from 70.5 to 72. This does not apply to people who already turned 70.5 before 2020. This change provides people the opportunity to do partial Roth IRA conversions for two more years. Whether or not this applies to you depends on your tax rate now versus your heirs’ future tax rate.

Ten Year Rule

Non-spousal beneficiaries who inherit an IRA must withdraw all the funds in the account within 10 years. Beneficiaries have flexibility during the 10 years, but the account must have a zero balance at the end of 10 years.

Retirement Contributions Extended

Retirees now may contribute to IRAs after age 70.5. Previously, contributions could not be made after age 70.5. This will provide people working past age 70.5 with the ability to make IRA contributions and receive the corresponding tax deduction.

Confirm Beneficiaries

Some people have named trusts as the beneficiary of their IRAs. These trusts often have language in them entitling the beneficiary to no more than the annual required minimum distributions from the IRA. Under the SECURE Act, there are no required minimum distributions until year 10, which may not be the intended purpose of the trust. Be sure to contact your attorney to review the terms of the trust and confirm if changes are needed.

STAY IN THE LOOP