Our market research summary for the 3rd quarter 2019 is short, concise, and actionable. The goal of this effort is to provide you with an educational executive summary with the advice you need. We would love to hear your thoughts on it and answer your questions.

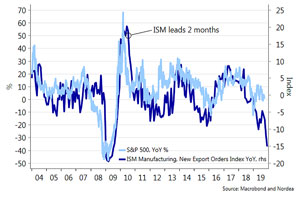

1. Manufacturing Data Suggests Lower Stock Prices

The US economy is slowing, but no one can predict the future severity of the slowness. Will it still be growth but at a slower rate, or will it result in a recession? September’s ISM Manufacturing PMI report suggested US factory activity is rapidly shrinking. Although this data series can be volatile, it is suggesting stock prices will be lower the next few months.

2. Returns Made In The USA

US stocks have outperformed non-US stocks since 2011 by a wide margin. The rising US Dollar is partially responsible for this disparity. Impact Capital started managing portfolios on 10/1/2018. Since then, our portfolios have been overweight US bonds and underweight non-US stocks in an attempt to simultaneously outperform while also lowering risk. We will unwind this positioning should the US Dollar weaken substantially.

3. Looking For Bargains In The Value Bin

This is an example into our evidenced-based investment process. We don’t invest based solely on valuations or hunches. We wait for the markets to confirm our view before taking a position. Growth stocks have outperformed value stocks since 2009. The out-performance accelerated since 2014 and may have reached an extreme recently. We are evaluating adding value stocks to the portfolio for the first time in a long time.

Have questions? Let’s discuss.

Reach out to us at: BBancroft@ImpactCapLLC.com (301) 417-3300

We encourage you to follow Impact Capital on social media:

https://twitter.com/impactcapllc

https://www.linkedin.com/company/impact-capital-llc/

https://www.facebook.com/ImpactCapLLC

STAY IN THE LOOP