I hope this finds you safe and healthy. The bottom line is we feel the market has more downside before finding a long-term bottom. For that reason, we continue to be positioned conservatively. Looking forward, there are three stages on the path to us investing more aggressively:

- Invest any cash on hand not needed during the next nine months

- Rebalance the allocation back to our current conservative allocation

- Change the allocation to be positioned on target versus conservatively

We’ve been investing cash and rebalancing portfolios, but have not changed our allocations. This approach is aligned with our view of more downside for the market. With that introduction, please find attached our three current market themes.

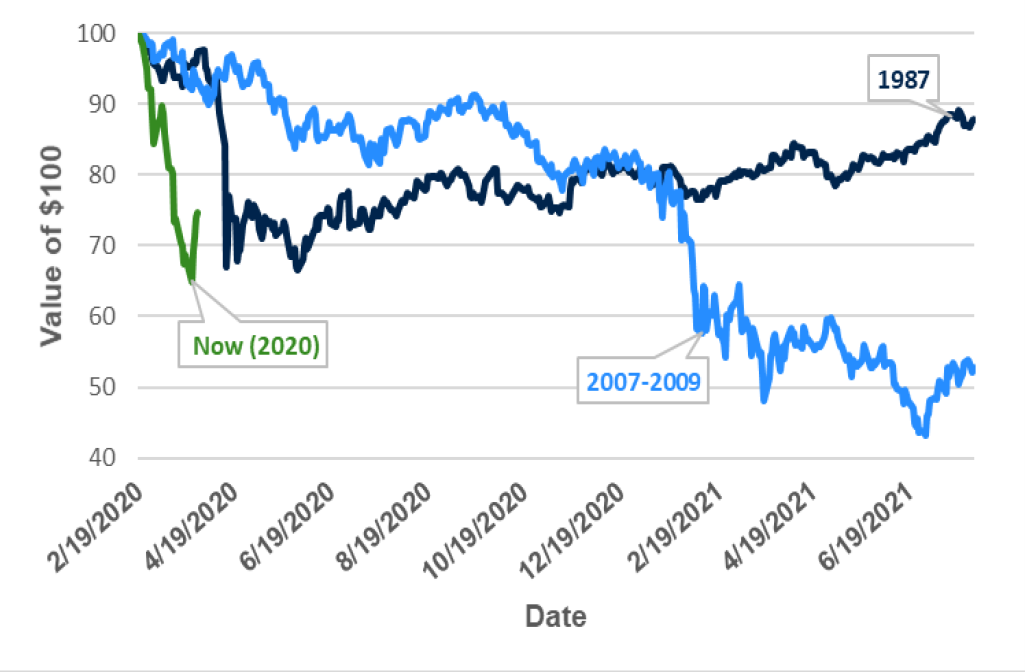

Bear Market Comparisons

The first theme lays out the three stages of a bear market and compares the current market to two historical extremes in order to provide you a frame of reference. The first historical extreme was 1987. In 1987 the market crashed, but didn’t go much lower after than the initial panic. This would actually be the “good” outcome since the current market has already gone through the initial panic. The second historical extreme was 2007-2009. This would be the “bad” outcome since stocks fell for six months after the initial panic in October 2008 before finding a bottom in March 2009. Time will tell.

Investors Need Cash Flow, Not Yield

The second theme discusses our reasoning for investing in fixed income. For diversification to work properly, we depend on fixed income investments to hold their value when stocks are falling. While this may have seemed conservative when stocks were rising, it has paid off this year. We show the performance of other popular income-producing investments and how they have not protected investors this year. Investors in these other income-producing investments did not diversify their risk and suffered large losses.

CARES Act

The third theme isn’t a market theme at all. Instead, it shares the highlights of the recently passed CARES Act. There could be meaningful opportunities to limit your taxes this year as a result. We will evaluate the Act and how it impacts your taxes and reach out to you individually but here is a quick break down:

- Direct Payments – Individuals who had up to $75,000 in adjusted gross income (AGI) in 2019 will receive a one-time payment of $1,200, while married couples with income up to $150,000 will get $2,400. The payments phase out at income levels of $99,000 and $198,000, respectively. There is also a $500 payment for each dependent child.

- Tax Deadlines – Tax returns and payments are not due until July 15, 2020. Estimated taxes are also not due until July 15, 2020. This date also applies to retirement account deposits for 2019.

- Required Minimum Distributions – Required minimum distributions have been suspended for 2020. Distributions made earlier in the year may be replaced without being taxed.

- No Early Distribution Penalty – Individuals impacted by the current crisis can withdraw up to $100,000 regardless if they are 59.5 years old. These distributions are still taxable, but the taxes will be spread out over three years.

- Charitable Contributions – Taxpayers can deduct $300 in cash contributions regardless if they itemize their deductions. In an effort to support qualified charitable organizations (not your donor advised fund), individuals can claim up to 100% of their AGI in 2020. The standard limit of 50% of AGI will return in 2021.

STAY IN THE LOOP