Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In the latest installment of Impact Capital’s Three Market Themes quarterly research report, we focus on U.S. Dollar-denominated assets, the diminishing hype surrounding Bitcoin, and the importance of maintaining a diversified stock portfolio in uncertain economic times.

1. A Growing Lack of Confidence in U.S. Financial Assets

The biggest story in the stock market recently has been the underperformance of American assets relative to the rest of the world. Historically, investors would flock to the U.S. Dollar in search of safety in volatile economic times, but this is not the case this year.

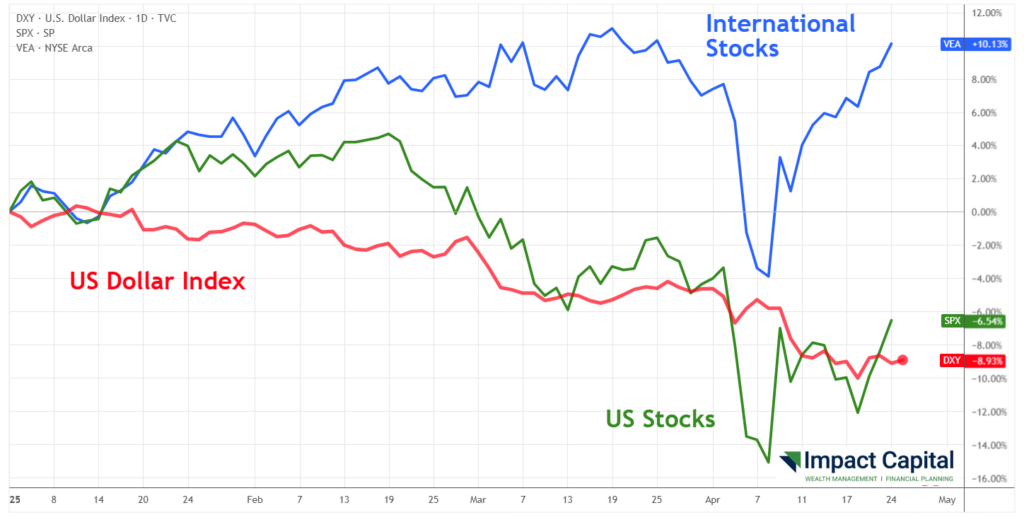

The U.S. stock market is down (-6.54%), but the U.S. Dollar Index is down almost (9.0%) this year. The chart above shows the performance of the U.S. stock market, U.S. Dollar Index, and international stocks. As U.S. stocks have fallen, there has been no meaningful recovery by the U.S. Dollar, with assets now fleeing the U.S. markets.

Markets do not like uncertainty, and the temperamental on-again, off-again status of the new presidential administration’s tariffs has shaken confidence in the U.S. markets and economic leadership. With the recent change in administration, the U.S. has adopted a more protectionist posture compared with the global policies of the previous administration. It only makes sense that the rest of the world would start making contingency plans to reduce their exposure to the United States.

The silver lining to this story is international stocks – which are actually up 10% this year – are worth more when the U.S. dollar is falling.

2. Spoiler Alert: Bitcoin is Not a Viable Currency

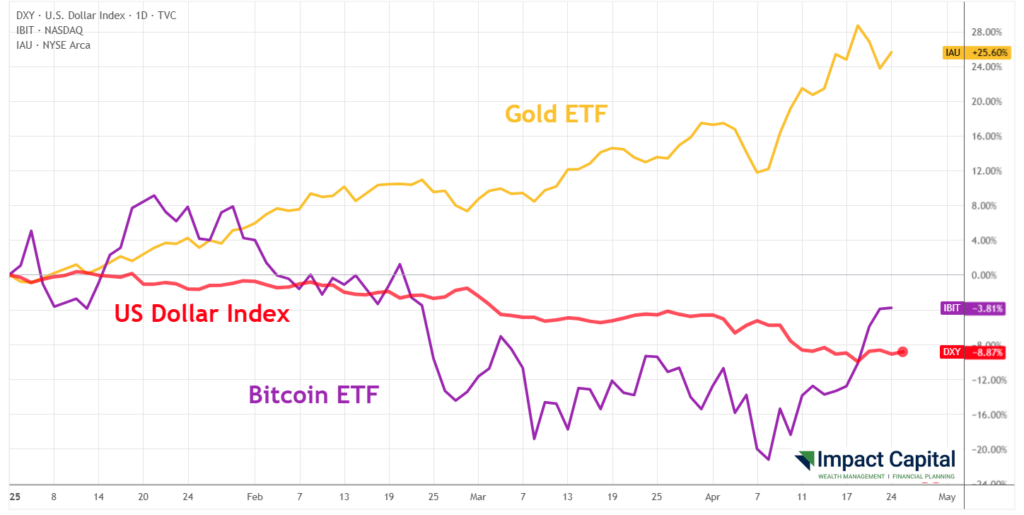

Part of the hype surrounding Bitcoin when it first entered the market was the prediction that it would become a viable alternative currency to the U.S. Dollar. With inflation rising and the national debt growing, the hype would now have you believe the U.S. Dollar will soon become worthless. As we discussed above, the U.S. Dollar has lost (9.0%) this year, so this is Bitcoin’s time to shine, right?

Nope.

Bitcoin is actually down (3.8%) this year. At this point in time, Bitcoin is not a viable alternative currency, but rather a speculative asset that rises when people have money to speculate with.

A currency needs to be relatively stable to be effective and viable. Imagine you found your dream home in January and scheduled closing for early April. In this scenario, no one needs to worry about what the U.S. Dollar is doing in this scenario: $1 in January 2025 is still worth $1 in April 2025.

Now imagine you planned to use Bitcoin to buy your home instead of greenbacks. $1 of Bitcoin in January 2025 is now worth only $0.80 as of April 2025. Your “currency” just lost 20% of its value in the span of four months.

Gold has been a star performer this year, up 25%. We previously wrote about gold a year ago in our April 2024 edition of our Three Market Themes research report series – you can read it here.

3. Always Remember to Diversify and Rebalance Your Assets

The table below shows the annual returns for all the major asset classes: U.S. stocks, International stocks, Emerging Market stocks, Real Estate, Commodities, Bonds, and Gold. Each year, the asset classes are ranked from best to worst performance, with the resulting table looking like a quilt made up of squares in different colors. There is no rhyme or reason that can help predict which asset class will be on top next year.

The performance of a simple diversified portfolio is shown in the white boxes of the chart, which you may notice tend to remain in the middle in most years. Over the span of time from 2010 to 2024, the diversified portfolio finished second only to the S&P 500, and demonstrated significantly less volatility than the S&P 500 during that time period.

Holding a diversified portfolio means you don’t have to constantly try to predict what is going to happen next. What are the odds you would be able to correctly predict the future consistently year after year?

When an asset you own loses value at the same time another asset you own gains value, we rebalance the portfolio by buying what fell and selling what went up. This way the make-up of your portfolio remains consistent and aligned with your long-term financial planning goals.

We believe that owning a diversified portfolio, as well as proactively rebalancing during uncertain and volatile economic times, is a prudent approach to long-term investing.

STAY IN THE LOOP