Our Unique Approach

The goal of our investment process is to take the emotion out of investing by using a disciplined process to risk management. Having extensive trading experience provides us with a unique approach to investing portfolios for the long-term. Risk management is key to any trading program. Our goal is to bring this benefit to you while maintaining the benefits of long-term investing such as tax-efficiency.

How it Works

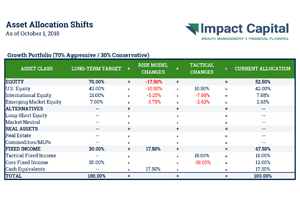

We start with the allocation custom designed to meet your goals based on our planning work. We then apply any necessary changes based on our risk management algorithms. It is the exception when these algorithms recommend reducing risk. It often goes years between changes. Finally, we make tactical changes based on relative strength and valuation metrics. We expect to make tactical changes to portfolios approximately three times per year. To execute this process, we believe in using passively managed exchange traded funds because of their low fees and tax efficiency. The chart below illustrates this process and shows our current allocation.

STAY IN THE LOOP