As a society, we need to learn to have more patience. You can probably think of a time within recent memory when you could have practiced more patience. Impatience is rampant everywhere these days: in traffic, at the grocery store, at restaurants, etc. Anywhere there is a large group of people, you are likely to see at least one person who lacks patience.

The typical investor’s biggest problem also tends to be a lack of patience. We make famous those who bet it all at the right time; the more sensational the story, the better. No one wants to read a story titled, “How They Made a Million Dollars over 30 Years: They Worked. They Saved. They Invested.” Even worse, no one wants to read a story about the people who bet it all and lost it all because they bet wrong.

We live in an age in which we are constantly inundated with news, opinions, and insights from each and every direction, all of them with some type of assigned action for you to execute now.

They write “Buy this! Sell that! Make this move!” with a vague sense of urgency, never mind the fact the people sharing these insights don’t know anything about you, your tax situation, your risk tolerance, or your financial goals.

When I hear people talking about investments, I imagine they are simply telling me about their favorite flavor of ice cream. They are simply sharing their opinion – nothing more, nothing less. Frankly, their opinion of the future and their favorite ice cream are one and the same in that they are equally useless. No one has any idea what will happen in the future, and even if they did, they certainly wouldn’t tell anyone, let alone share it on TikTok. You like Rocky Road? Great, I like Peanut Butter Swirl (preferably from the Penn State Creamery).

“The long-term is simply a bunch of short-term time periods linked together.” This is a statement I’ve heard that—at face value—supports short-term trading. While true, it doesn’t tell you how to maximize your short-term investing in order to maximize your long-term results in turn. What does the data say?

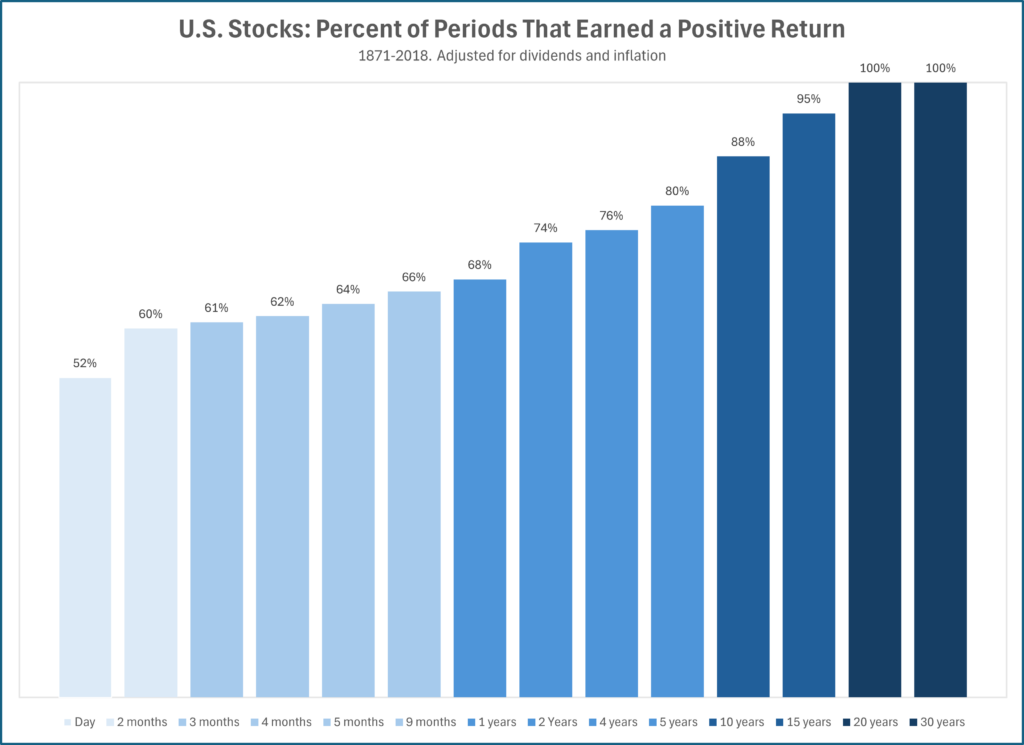

The chart1 above shows how often the stock market has been up over different time periods. Notice how it shows the longer the time period, the higher the chances of the market’s return being positive, but the shorter the time period, the more it becomes akin to a coin toss. Another way to look at it is to say holding for ten years or more makes you an investor. Any time period less than that and you are speculating. Investors rely on the free markets whereas speculators rely more on luck.

Short-term trading would be like betting on balls and strikes when you already knew which team would win the World Series. Don’t like the baseball analogy? Have a movie quote instead. The computer in the 1983 movie War Games could have been talking about short-term trading instead of global thermonuclear war when it said: “A strange game. The only winning move is not to play.” That’s good advice in my book.

1Morgan Housel, Same as Ever: A Guide to What Never Changes (New York, NY: Portfolio/Penguin Random House, 2023), p.91

STAY IN THE LOOP