Checking in on the Four Comma Club

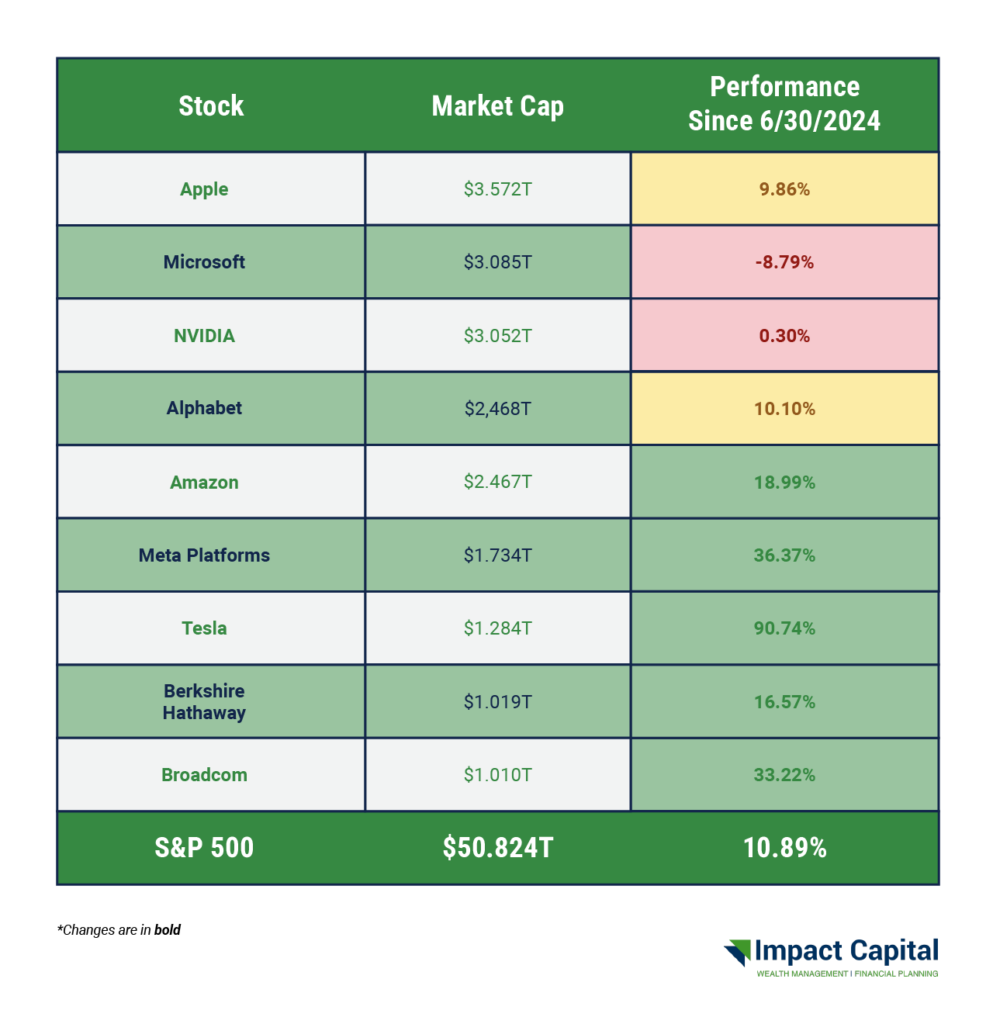

The Four Comma Club refers to those U.S. stocks whose market capitalization1 is greater than $1,000,000,000,000. One of the biggest trends in the stock market last summer was how the largest stocks in the S&P 500 were responsible for almost all the gains in the index. The table below shows how the Four Comma Club stocks have performed from June 30, 2024 through January 30, 2025.

You will see the very largest stocks like Apple, Microsoft, NVIDIA, and Alphabet are no longer pushing the market higher. In the case of Microsoft and NVIDIA, they have actually held the market back. Who would have thought that was going to happen last summer?

Technology Stocks are Lagging Behind in the Market

One of the go-to cheat codes for outperforming the market since 2013 has been to overweight technology stocks relative to the market. In general, technology stocks have been more volatile than the overall market. When the market has gone down, technology stocks have fallen lower than the market. When the market has gone up, technology stocks have gone up higher than the market. The market has gone up in the last few years, so technology stocks have shot up even more. This dynamic is depicted in the chart below showing the performance of the technology sector of the S&P 500 versus the entire S&P 500 during the period from 9/30/2022 to 6/30/2024.

Everything was working like it always had, but then something changed last summer. Since then, the market has continued to move higher, but technology stocks have struggled. Perhaps the valuations on technology stocks became too expensive, or perhaps investors were finding values elsewhere in the market.

It doesn’t mean those stocks won’t go on to do well in the future; it just means that technology stocks don’t outperform all the time. In fact, most stocks typically underperform the overall market.

Where are the Customers’ Yachts?2

Most stocks don’t beat the market; let that sink in for a moment. Trying to pick stocks that beat the market is against the odds. Even worse, the idea of paying someone to try to pick stocks to beat the market seems like an obviously bad idea. And yet, these next two statements are both true:

- No one can predict the future.

- Americans pay millions of dollars in fees to fund managers who try to predict which stocks will beat the market in the future.

How are those managers’ results?

According to Standard & Poors, 90% of the actively managed funds underperformed the S&P 500 over the last three years as of 6/30/2024.

Pardon me?

Say what?

Are you kidding me?

Bruh.

90% underperformed?!

That’s a problem. Most of us are investing for longer than three years. S&P states the underperformance of actively managed funds is 94% over the last 20 years.

This is why the team at Impact Capital predominately uses investments that match the market’s return. By matching the market’s return, we expect you to beat most of the other funds out there. We also expect you to save money on fees and taxes, too! Whether you buy a yacht (or not) is up to you!

1Market Capitalization is the total dollar value of a company’s outstanding shares at the present market price.

2 Six decades ago, Fred Schwed wrote a book called Where Are the Customers’ Yachts? The title came from a story about a tourist visiting New York more than a century ago. After admiring fleets of yachts Wall Street bought with money earned managing portfolios for customers, he wondered where the customers’ yachts were. Of course, there were none.

STAY IN THE LOOP