My favorite financial planning suggestion to young adults is to move funds into a Roth IRA. Do you have a summer job? Put some of your earnings into a Roth IRA.

I can hear the objection that springs up almost immediately. “Why worry about retirement now? It’s so far away and my grumpy older self will be rich 50 years from now.” That is the thought that runs through the minds of most college students. When you’re young and don’t yet have all the financial commitments that come with adulthood, buying Taylor Swift concert tickets and traveling may be a higher priority than retirement planning. That being said, putting a little bit of retirement savings aside now goes farther than putting more retirement savings aside later.

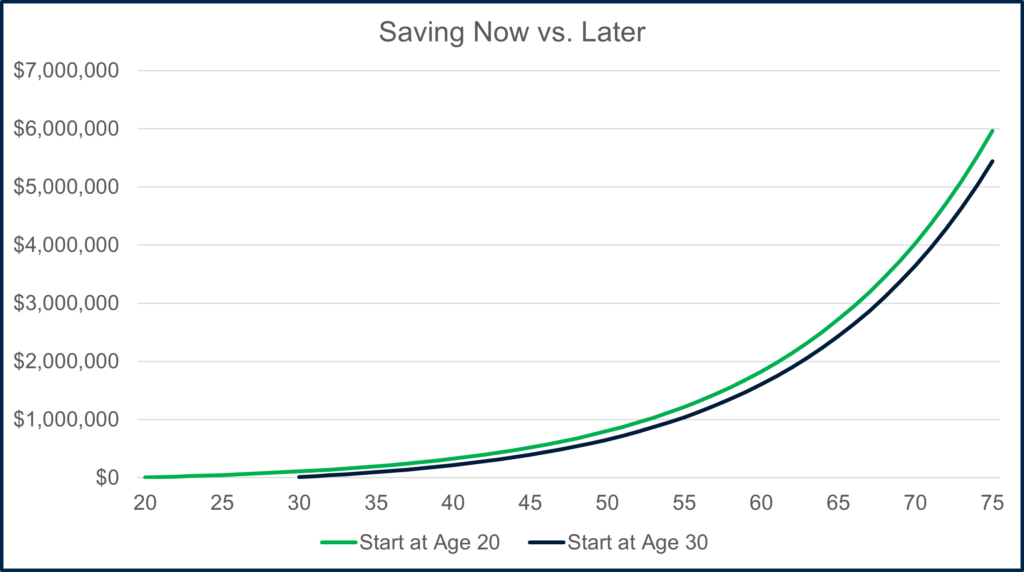

Beginning to invest in your Roth IRA as soon as possible can have a massive impact on your retirement funds over the long term. This graph below compares saving at age 20 to waiting to save until age 30.

From a quick glance, the lines look so similar you may be thinking to yourself, “It’s not that big of a difference. I can get away with waiting 10 years to start investing in my retirement, so why bother saving at age 20?” The 20-year-old in this example starts saving $6,500 a year from age 20 to 75, while the 30-year-old starts saving $13,000 a year until age 75. Over the course of this timeframe, the 20-year-old saves only $364,000, while the 30-year-old saves $598,000. In this case, the 20-year-old accumulates more wealth than the 30-year-old, even though they saved less for retirement, assuming the investments grew at a constant rate of 8% per year.

Investing funds into Roth IRAs are the perfect route for saving while you’re young for several reasons. First, Roth IRAs grow tax free forever. Second, there are no minimum distributions required in retirement. Third, contributions are made after tax. Additionally, you can contribute whichever is less: your earned income for the year or $6,500 ($7,500 for those 50 and over). Roth IRAs were built for middle-income Americans to be able to save for retirement. If you do become wealthy, you won’t be able to contribute to a Roth IRA because the government imposes income restrictions over who can fund a Roth IRA.

Beginning to invest in your retirement in high school or just out of college gives you a massive benefit in comparison to waiting until your thirties to start planning for retirement. Your 70-year-old self will greatly appreciate your 20-year-old self investing any funds put forth for your retirement.

Written by Christopher Bancroft

STAY IN THE LOOP