Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In the latest installment of Impact Capital’s Three Market Themes quarterly research report, we focus on historical fourth-quarter stock market performance, the appeal of non-U.S. stock market assets, and all-time stock market highs.

1. Don’t Be Spooked Just Because It’s Spooky Season

October gets a bad rap for being a scary month for the stock market. Sure, the three largest stock market crashes in history were all in October (1929, 1987, 2008), but how long are we going to hold that against the month of October? You may be surprised to know that October marks the first month of the best performing quarter of the year – and it isn’t even close.

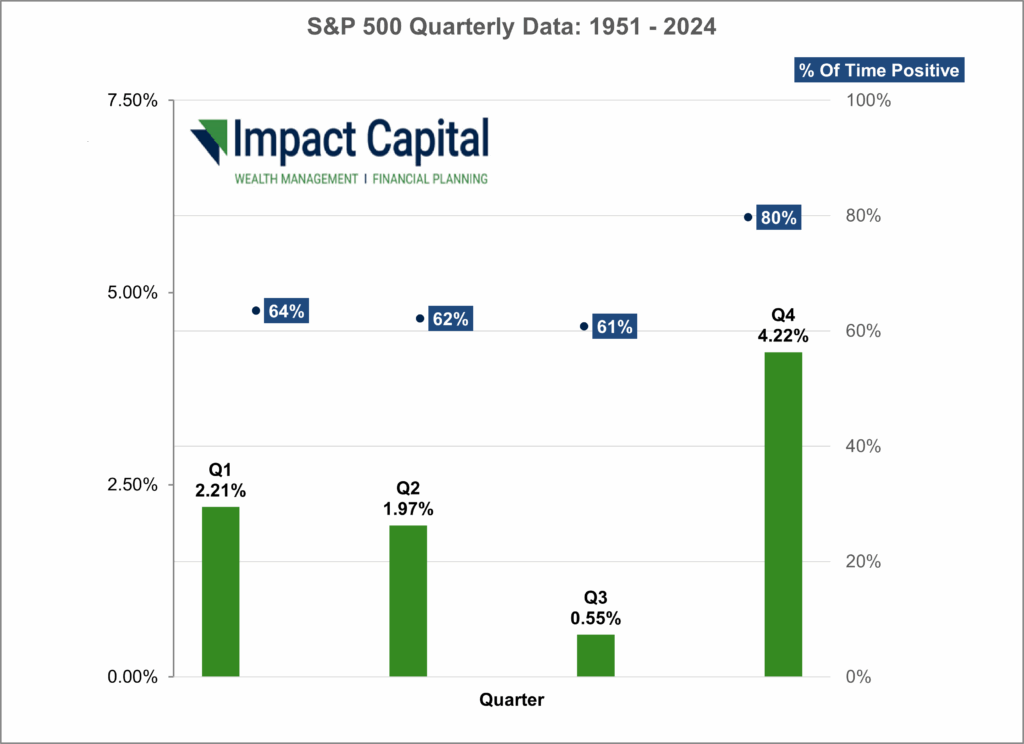

The green bars in the chart below show the average return of the S&P 500 for each quarter of the year from 1951 to 2024. As depicted in the chart, the fourth quarter (Q4) historically had the highest average return of 4.22%, with the next-best quarter being the first quarter (Q1), which earned 2.21% historically.

Not only was Q4 the top performing quarter in terms of stock market performance, but it was also positive more often than the other quarters. Q4 was positive 80% of the time versus only 61-64% for the other quarters of the year.

So go ahead and enjoy all the autumnal delights that October has to offer: Halloween, pumpkin-spice everything, changing leaves, and strong stock market performance.

2. The Compelling Case for International Stocks

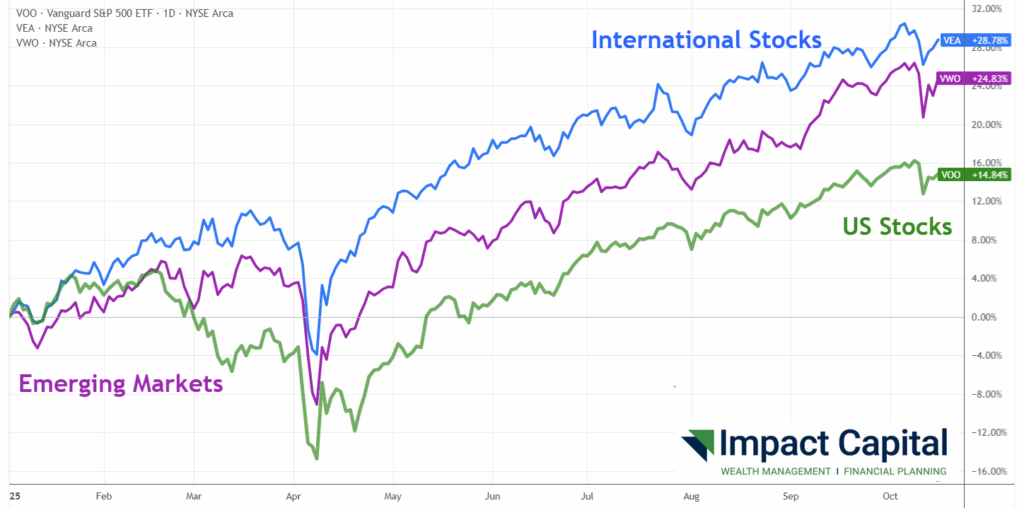

This year, non-U.S. stock markets have consistently outperformed the U.S. stock market. As you read this, the international stock index, MSCI EAFE, is up by 25% this year, and the index for emerging market stocks, MS Emerging Index, is up by 29%. By comparison, the S&P 500 is up by 14%.

The case for investing outside the U.S. is based on three factors:

- Diversification – Spreading your risk out makes sense when the S&P 500 has almost 40% of the index invested in the top ten stocks. The hope is that the non-U.S. stocks would continue to perform well even when the S&P 500 does not.

- Valuations – The price/earnings ratio1 of the S&P 500 is around 22, which is near the highest level it has been in the last 20 years. Meanwhile, the valuations on non-U.S. stocks are near the low end of the range of the last 20 years. This is what happens when U.S. stocks outperform non-U.S. stocks over the previous ten years.

- Falling U.S. Dollar – The dollar had appreciated 56% from 2008 through 2022, but it has now started falling. A falling dollar helps investments outside the U.S. appreciate. Some countries, like China, may be selling U.S. dollars to buy gold.

1 The price/earnings ratio is a valuation metric calculated by dividing the market’s share price by its earnings per share. High P/E ratios imply the market may be overvalued (and vice versa).

3. Don’t Be Afraid of Climbing to New Highs

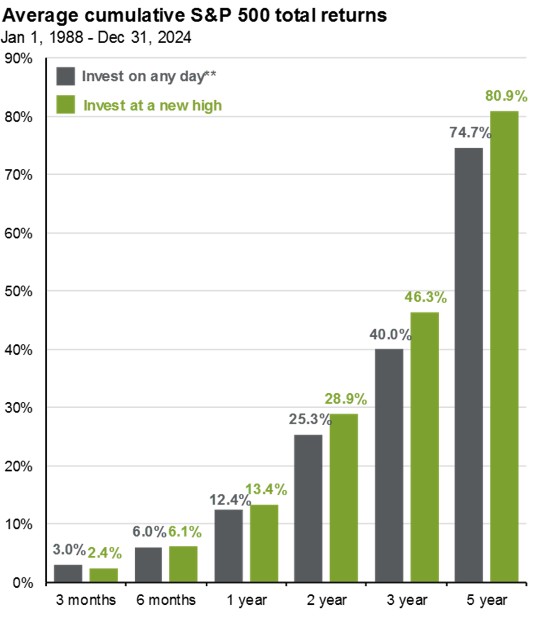

It is totally reasonable to feel scared when buying something that is near an all-time high price. While it feels better to buy it on a dip, this is a clear example of how our emotions can betray us. The chart from JPMorgan below shows the difference in performance between investing on any given day compared to investing only when the stock market is at new highs. Buying the S&P 500 on days hitting new highs has consistently outperformed buying at random levels:

Think about it in terms of supply and demand: When the market climbs to an all-time new high, it tells us there is more demand than supply. There is a complete absence of overhead supply from investors who bought at higher levels, and everyone who bought into the market has made money on their investment. It is also very likely the market is trending higher. Long story short, this trend is your friend.

The stock market is also a recession indicator. It tends to predict more recessions than actually occur, but when the market is hitting all-time highs, it is also indicating the probability of recession is low.

Don’t let your emotions betray you. The lesson here is to view all-time highs as treats, not tricks.

STAY IN THE LOOP