Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In the latest installment of Impact Capital’s Three Market Themes quarterly research report, we focus on the positive returns across all types of investments, the risks in today’s stock market, and the drawbacks of wealth management clients working with active fund managers.

1. The Everything Bull Market

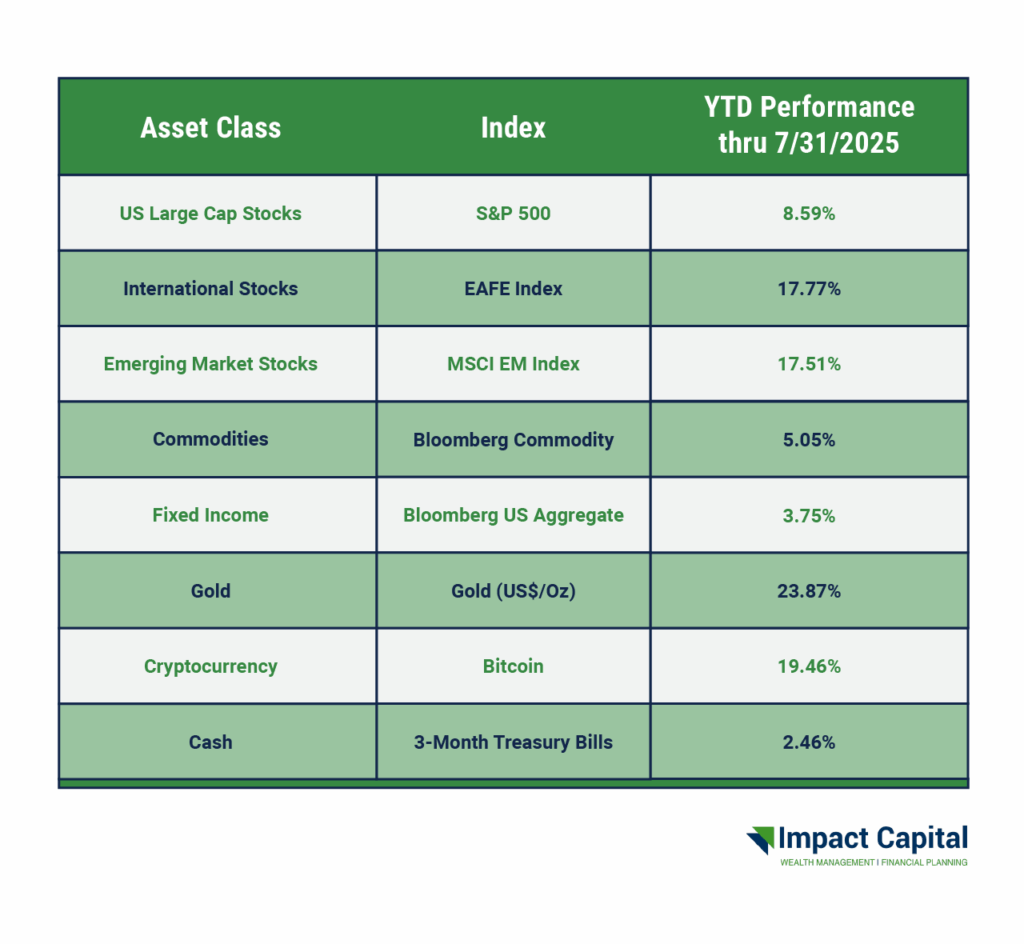

Markets have been soaring higher since bottoming out in the aftermath of the Trump administration’s tariff announcement in early April – everywhere you look, you see higher prices. The table below shows the year-to-date performance of various asset classes.

Why has everything gone up? For starters, tariffs were paused until very recently, and corporate earnings continue to beat investor’s expectations, driving stock prices even higher. Technologies like artificial intelligence have also helped make companies more productive and profitable. The combination of expected interest rate cuts from the Federal Reserve as well as lower taxes and deregulation from the Trump administration and Congress could continue to boost corporate profits.

2. What could go wrong?

Let me preface this next section by reminding everyone that we are long-term investors – we don’t try to predict what will happen next. That being said, it is also prudent to be aware of the risks in the markets today. Here are three risks we see:

Concentration: The top 20 stocks in the S&P 500 – which are all concentrated in the technology sector – now make up half the index. When that much of the index is in a small basket of names, one little slip can take the entire market down.

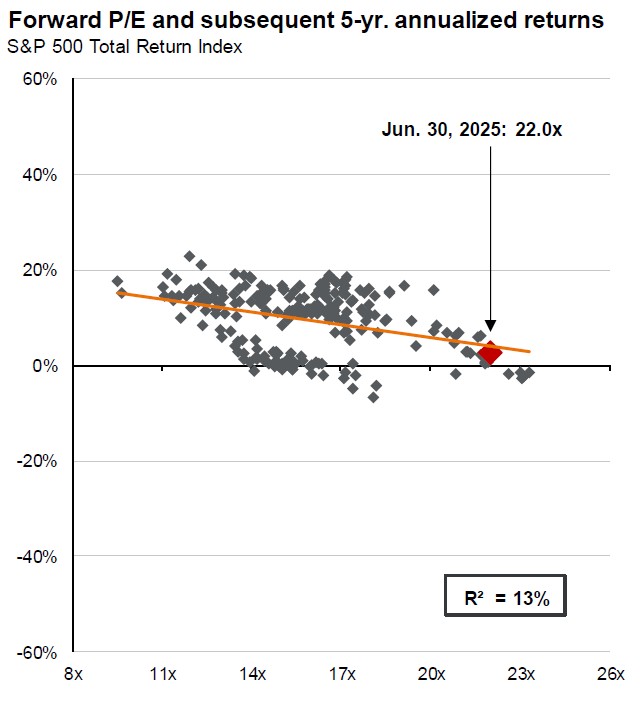

Valuations: Theoretically, a stock is worth whatever their earnings will be in the future. In reality, a stock is worth whatever investors want to pay for it. Investors can be emotional, bidding stocks higher out of greed or hammering stocks when they are down out of fear. Comparing the price of the market to the underlying earnings results in a concept called the P/E ratio; the higher the P/E ratio, the greedier investors are.

The current P/E ratio of the S&P 500 is around 22, compared to the average P/E ratio which has hovered around 17 over the last 30 years. High valuations imply high expectations for future earnings, but if earnings fail to meet these high expectations, then stock prices may correct sharply. The chart below from JP Morgan shows the relationship between the P/E ratio and the subsequent five-year returns.

Before you rush to sell stocks and put the cash under your mattress, there is a good amount of variability of future returns that is not accounted for by valuations. Additionally, there are plenty of other factors that influence future returns to take into consideration.

Recession: Some people fear a recession could be on the horizon. Since tariffs were largely delayed up until recently, the full effect of the tariff policy has yet to show up in the economic data. Some fear the additional taxes will weigh on both corporate earnings and consumer spending.

The most recent employment report came in much weaker than expected, and the last two months of data were also revised lower. In addition, consumer confidence has been falling, reflecting growing pessimism about personal finances and the broader economy.

One of the best recession indicators is the performance of the stock market. With the stock market nearing all-time highs, it implies the current risk of a recession is low.

3. Fortune Tellers Struggle to Predict the Future

Fund managers who try to pick stocks that will beat the market are struggling to do so – again. Instead of labeling themselves as active managers, a more accurate description would be fortune-tellers. Labeling them as fortune tellers would better warn clients about the odds of their likely success.

No one can predict the future, yet millions of people fork over their own hard-earned money to other people to try to predict the future. These firms don’t report performance of their funds on the client statements and these statements also don’t show a comparison of the fund performance versus the market performance. This isn’t an oversight – it is a deliberate attempt to keep clients from knowing they would be better off invested differently.

New data from Morningstar reports that just 31% of the U.S. equity active fund managers outperformed the market in the 12-month period ending June 30, 2025. Keep in mind you aren’t investing for just one year, but for the long-term. Only 8% of actively managed large-cap U.S. equity funds outperformed the market over the last ten years.

Impact Capital does not employ any active managers. If the performance is likely going to be worse than the market, we believe it makes more sense to just own the market. To add insult to injury, active managers charge high fees and generate capital gains for their clients. The lack of financial education combined with both the glaring lack of transparency and oversight allow the wealth management industry to continue this client-damaging practice.

STAY IN THE LOOP