Impact Capital’s quarterly research report seeks to highlight the latest developments most relevant to your investments and financial planning. In the latest installment of Impact Capital’s Three Market Themes quarterly research report, we focus on the warning message from bonds, the performance of commodities, and the performance of the gold.

1. Bonds Are Sending Out Warning Signals

As we wrote last quarter, the popular belief among investors was inflation was going away and the Federal Reserve would start slashing interest rates. We were right to question that narrative, as bonds have turned out to be one of this year’s biggest losers. The chart below shows the performance of the iShares 20+ Year Treasury Bond ETF (ticker: TLT) over the past five years. Bonds peaked in 2020 and have been falling ever since, with the TLT now down over 9% so far this year.

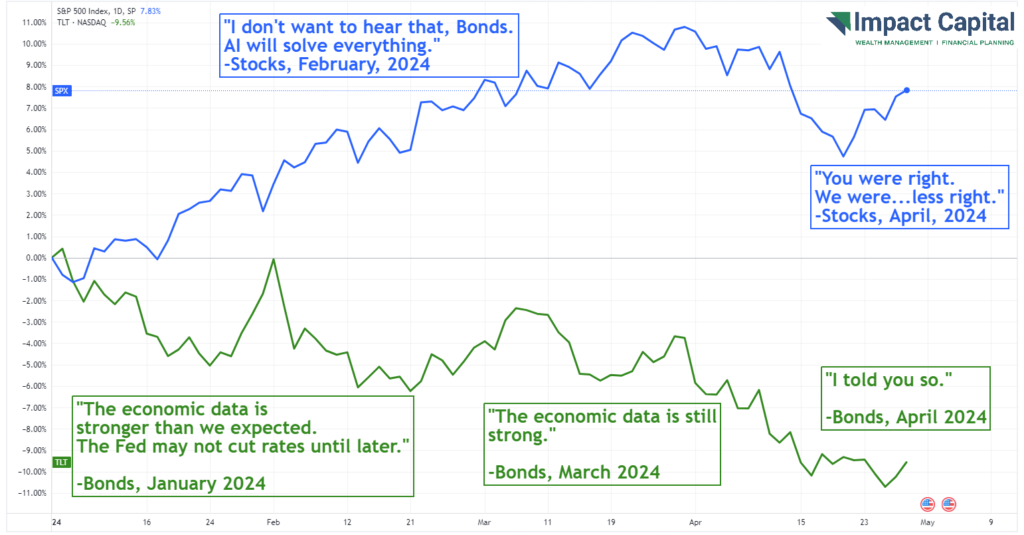

You don’t own TLT in your portfolio, but changes in interest rates can—and will—impact other investments. One of the reasons stocks were able to rally was on the assumption that lower interest rates were coming. Consequently, when bonds start falling, they tend to drag down stocks with them. I like to imagine a conversation between bonds and stocks going something like this:

Stock investors should be careful what they wish for, because if the Fed starts cutting rates, it’s because they have observed economic weakness. In other words, they would have realized they raised interest rates to too high a point that it is now restricting the economy. They would then proceed to try and fix things by changing course and lowering rates. Stocks investors may think lower rates would be great, but economic weakness leading to a recession would only be good for bonds, not stocks.

Now that the narrative has shifted to interest rates being “higher for longer”, we can’t help but wonder how long it will take for bonds to start a rally.

2. Commodities Are Doing Well Right Now

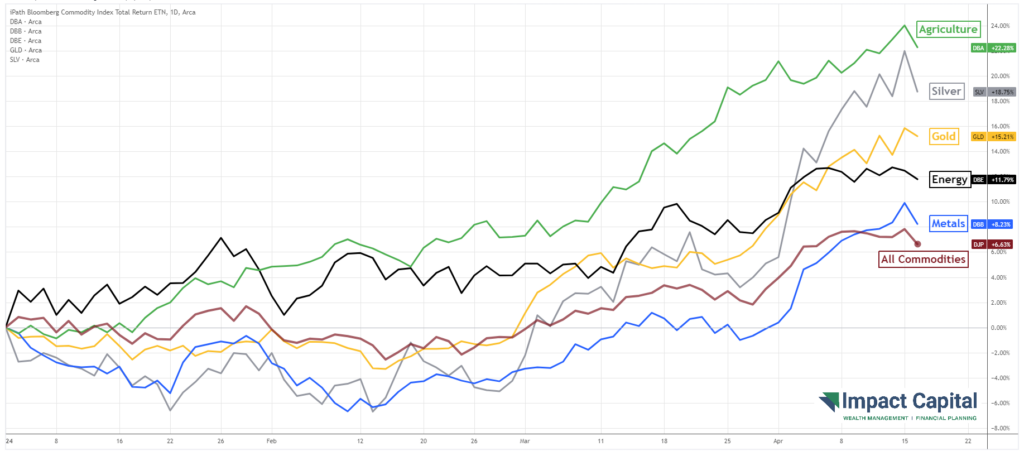

A stronger-than-expected economy may not be good for bonds, but it is good for commodities. The chart below shows the year-to-date performance for various commodities.

This year, many commodities are steadily rising in price more than stocks or bonds, and this is the case for all types of commodities – agricultural, energy, and the metals. Most portfolios are underweight in these types of investments. They certainly aren’t represented much in the S&P 500, which has come to be dominated by technology companies.

You may not hear much about investing in commodities because the long-term track record is not good. In general, we’ve gotten more efficient at growing and extracting commodities, and we’ve also gotten more efficient when it comes to using them over time. This may be why over the last 15 years, the Bloomberg Commodity Index ETN has lost 50% of its value, while the S&P 500 has made 430% and the U.S. Aggregate Bond index is up 47%.

This makes it difficult to commit to a long-term position in commodities. In the short-term, they are going up and may continue to do so until there is a recession.

3. All That Glitters (In This Case) is Gold

Gold always gets more attention than other commodities because of its price history. The price of gold is currently going up because central banks around the world are diversifying their portfolios in an attempt to hold fewer U.S. Dollars. Gold is also seen as a safe haven commodity when there is geopolitical uncertainty.

The price history of gold can be summarized in four distinct moves as shown on the chart below.

Gold is only worth what investors are willing to pay for it. While this is true for any investment, this is especially true for gold. Gold doesn’t have earnings, interest payments, or dividends, and it can’t buy back shares or get bought out. There is no workforce showing up to work each day to be innovative or productive. It’s a rock with limited industrial use — in other words, it is your parents’ Bitcoin. Having said all of that, it is going up and, based on history, it could continue.

STAY IN THE LOOP