Executive Summary

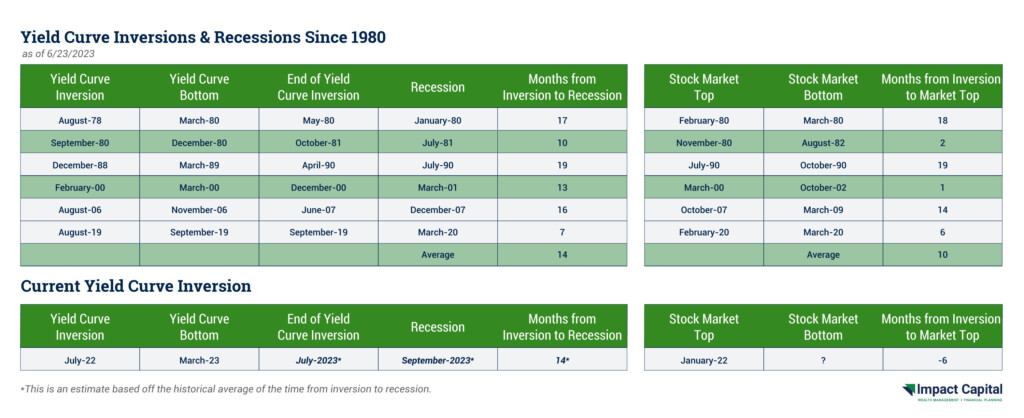

In recent months, there has been a lot of speculation from financial analysts about the possibility of a coming recession. Speaking from a historical perspective, in past instances when the yield curve inverted, the economy fell into recession an average of 14 months later. The yield curve inverted in July 2022, so if the economy follows that historical average model, then the economy would fall into recession in September 2023 accordingly.

Recessions Follow Yield Curve Inversions

We previously discussed yield curve inversions in our May 2023 blog titled “Market Themes: May 2023 – The Likely Coming Recession.” If you would like to refresh your memory, you can read it here.

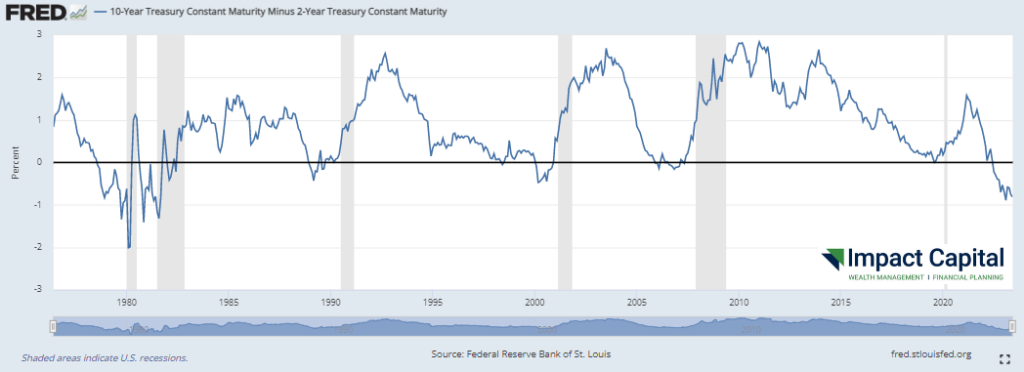

The updated version of the yield curve chart is shown below. The inversion is depicted where the line falls below zero, with recessions depicted as the shaded areas. As you can see from the chart, the curve is still inverted right now.

History demonstrates a clear pattern: the yield curve inverts, and a recession follows thereafter. The shortest recorded time between the inversion and a recession was seven months, while the longest recorded time was 19 months, with the average time being 14 months. The table below shows the underlying data.

From time to time, I like to ruminate on scenarios that would illustrate current trends and events relating to the stock market in an amusing light.

If the economy follows that historical average model, the economy will fall into recession in September 2023. If the economy does not follow the historical average model and instead follows the furthest ends of the model, thereby following the longest timeframe between the inversion and a recession, then the economy would be in a recession by February 2024.

Small Sample Size Disclaimer

This is a small data set of only six historical observations. In general, we should be careful not to draw conclusions from such a small sample size, as there are no guarantees this time won’t be different. We are dealing with probabilities, not certainties.

The Stock Market is Not the Economy (In the Short-Term)

The performance of the stock market has been different this time. Historically speaking, inversions usually happened before the stock market top, but this time, the stock market topped out six months BEFORE the inversion happened. One possible explanation for this market behavior could be the increased transparency of the Federal Reserve. Once the Federal Reserve announced they would be raising interest rates to control inflation in late 2021, the stock market topped in early January 2022.

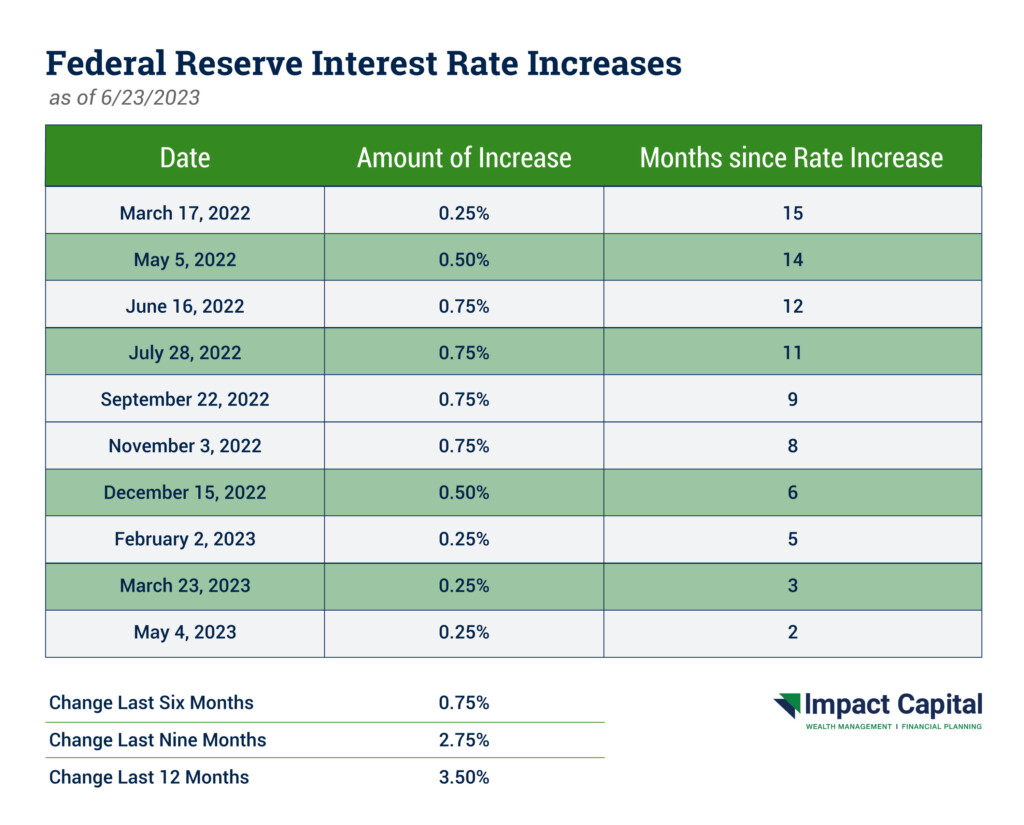

Interest Rate Increases

The Fed has said it takes between nine and 12 months for the effects of interest rate increases to be felt throughout the economy. That is not good news, considering interest rates were increased 3.5% in the last 12 months. The instances of interest rate increases along with their corresponding dates are listed below.

Hope for the Best, Plan for the Worst

We will continue to monitor both the economy and the stock market in the coming months and keep you updated as market conditions change. Our approach to this environment is to use defined outcome ETFs since they are expected to make money when the market is up and have protection in place in case the market goes down. Don’t hesitate to contact your advisor with any questions about these recent developments.

STAY IN THE LOOP