Integrated Tax and Financial Planning

Integrated Tax and Financial Planning

Your portfolio is customized with your unique goals in mind.

THE ADVICE YOU NEED. THE SERVICE YOU DESERVE.

Integrated Financial and Tax Planning

Our independent specialists use coordinated investment and tax advice to create customized investment solutions. Always mindful of taxes, we look for ways to add value for our clients through active tax management. We consider all the components that affect your financial well-being, including:

- Wages

- Standard Deductions

- Taxable and Tax-Exempt Interest

- Qualified and Ordinary Dividends

- IRA Distributions

- Pensions and Annuities

- Social Security Benefits

- Capital Gains and Losses

- Charitable Contributions

- Much More

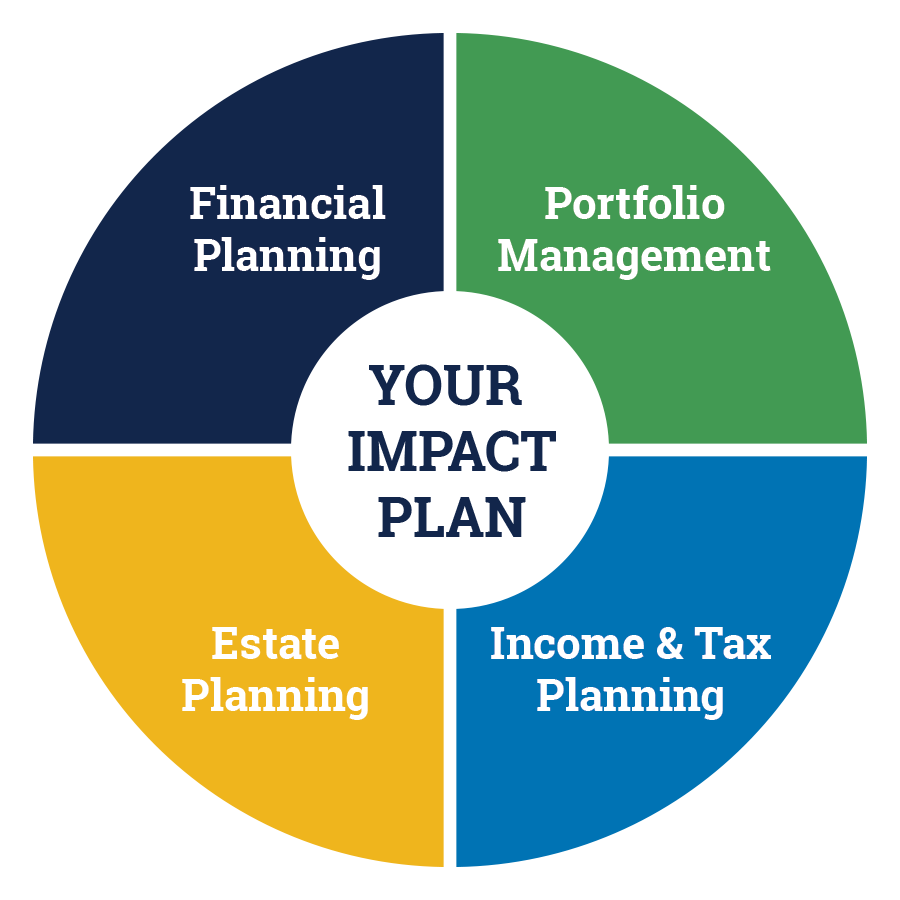

Guidance in All Areas of Your Financial Life

The way financial services information is curated and delivered is rapidly changing these days. At Impact Capital, we are always looking for more efficient ways to acquire insight from ever-increasing amounts of data so they can monitor the effectiveness of their products, strategies, and resources.

Comprehensive Financial and Retirement Planning

At Impact Capital, we do not believe in cookie-cutter solutions. That is why your investment plan is crafted specifically for your needs. To best serve you, we begin by listening as you describe your goals and objectives. We then formulate a plan that meets your needs by analyzing your current asset allocation for both performance and volatility.

Next, we build a list of recommendations with careful regard for how they individually and collectively advance your position. We pay particular attention to the tax aspects of your investment choices. Whether using exchange-traded or mutual funds, we will transform your strategies into a comprehensive initiative geared to meet your current income needs and future capital requirements. Over time, your needs will change, and new opportunities will arise. As our client, we consider it our responsibility to look out for your best interests throughout the years, always seeking the best ways to achieve your long-term investment objectives.

Tax-Efficient Investments and Retirement Planning

Our diagnostic process includes advice on your tax planning, retirement, cash flow, education funding, insurance, and overall balance sheet management. In the typical advisory firm, the number of advisors greatly outnumber the accountants. In our firm, we are literally surrounded by accountants. There is value and convenience in aligning your planning advice, tax advice, and portfolio management.

Your tax return and investments are more related than you may realize. Using a coordinated approach can add value in the form of tax savings which can lead to more growth in your portfolio over time. After all, it isn’t what you make, it’s what you keep that’s important.

We focus on what we can control. While we can’t predict what the markets will do, we know managing the portfolio in a tax-aware manner will minimize your taxes. Doesn’t it just make sense to hire a professional who can integrate your planning together? Learn more here.